Brandon Michaels

EXECUTIVE LEADER

Kansas City, MO, USA

Transformational and charismatic leader reputed for building high-performing teams, elevating organizations, and fostering innovative and growth-oriented mindsets. People-Focused. Change Agent. Growth Hacker. Thought-Leader.

Visionary professional respected for elevating talent and driving sustainable and purpose-driven results.

[email protected] | brmichaels | 816-885-6616

A High-Visibility Brand Builder. Experience leading community financial institutions in various markets. Passionate about taking dormant organizations and rejuvenating their soul. Experience transforming companies into an industry powerhouse through internal development, mentoring/coaching, growth hacking, and digitization. Strong orientations in marketing/branding, finance, and data-driven decisions that galvanize and inspire teams to reach award-winning performance and customer experience. An impressive record of results through an entrepreneurial mindset and servant-leader philosophy.

Leadership Profile

- 19 years' Executive Experience

- Brand Builder

- Growth. Hacker.

- Major Organizational Turnarounds

- Digital Transformation, MIT Sloan School of Mgt

- Board Relations & Leadership

- Public Speaking

- Agile Methodology Operating Model Implementation

- Company Culture

- DiSC: I/D

Professional Experience

Chief Financial Officer

DoubleCheck Solutions, LLC

August 2021 - Present

Transformative fintech that allows consumers to reprioritize their overdraft transactions and avoid fees

Responsible for the scalable financial strategy, including revenue projections, sales leadership, tax implications, valuation calculations, audit, and investor relations. Intimately involved in every function of the business from technology implementation, operations, audit, financial analysis, and strategy.

Brought in as a thought-leader in the banking industry, I assist both Co-CEOs with strategies to scale.

President/CEO

JSC Federal Credit Union

August 2018 - April 2021

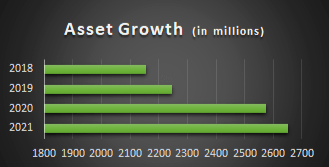

The second-largest credit union in Houston MSA with 22 locations and over $2.8 billion in assets, 350 team members

Recruited to transform the organization's operations and turn around a stagnant brand and enterprise built from operational silos with no defined culture, while spearheading growth and a new culture across the company - all during a time of economic instability. On track to reach $5B in 5 years and rebrand the company to be more inclusive of customers in Houston

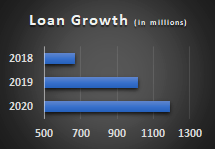

- OPERATIONAL TURNAROUND: Doubled the loan portfolio in two years and exceeded the industry growth average by 3x. Increased Net Margin 39 basis points when the industry average declined by 27 basis points

- FINANCIAL MANAGEMENT: More than doubled gross income at the same time we invested in new and relevant systems and hired 100 additional team members

- DIGITAL TRANSFORMATION: Migrated over 30 disparate systems from legacy platforms to future-driven and UX-centered platforms that

President/CEO

Mazuma Credit Union

January 2012 - August 2018

The second-largest credit union in Kansas City with 10 locations and nearly $700M in assets, 220 employees

Turned around an organization struggling with commercial lending fallout from the 2008-2010 market downtown. Inspired the executive team and Board toward a new strategic direction to drive relevance and growth. Broke financial records from 2015 - 2018. Consistently achieved Customer Experience scores of at least 4.7 out of 5.

- FINANCIAL TURNAROUND: Navigated rising loan losses to bring the institution back to profitability in under 2 years. Led a "Playing to Win" Strategic Mindset shift that produced above-average returns

- BRANDING & MARKETING: Transformed the brand of the institution that won Brand of the Year in 2015. One of the first credit unions in the USA to ever sponsor a Major League Soccer Team. Won over 50 awards for branding and marketing

- PURPOSE-DRIVEN: Created a purpose-driven organization invested in our communities based on the values established by our team and Board. Established one of the first-ever credit union corporate social responsibility programs and returned 5% of net profits into the Mazuma Foundation

Chief Financial Officer

Mazuma Credit Union

August 2009 - December 2011

$425MM in assets + CU Holding, Inc.

Recruited to lead the finance function of a complex, mid-size financial institution. Challenged with manual processes and growing market competition. Recruited to provide leadership to a subsidiary holding company that owned a basket of six different companies. CU Holding, Inc. was unprofitable and needed financial direction.

- FINANCIAL TURNAROUND: Upon arrival, the organization was too fee-heavy and had an unscalable operating model. Reduced the operating expense ratio over 100 basis points while still investing in digital infrastructure. Facilitated the automation of the lending process, achieving 15 minute turnaround times for members/customers

- ASSET-LIABILITY MANAGEMENT: Elevated the financial efficacy of the organization through advancing revenue and cutting expenses. Increased investment returns through diversification, lower front-end expenses, and more productive and strategic ALCO meetings

Chief Financial Officer

San Francisco Fire CU

August 2007 - August 2009

$620MM in assets

Recruited to help advance the strong expansion of the organization by positioning the balance sheet for growth. Reduced operational inefficiencies by reducing the accounting burden by 50%. Reduced the chart of accounts from 30 pages to 16. Managed the investment portfolio, brokers, and investment strategy. Worked across verticals to help streamline the organization's processes.

- ASSET-LIABILITY MANAGEMENT: Advanced the asset-liability management process by reducing risk over 40% in the rising-rate scenario

Other Relevant Experience

Controller

Cal State 9 CU

October 2006 - August 2007

Streamlined the accounting department to produce financials within 4 days, a Board requirement. Managed a complex investment portfolio to support rapid growth and produce above-average returns.

Chief Financial Officer

Inland Empire CU

2005 - 2006

A financially struggling organization recruited me to help turn them around. Produced profit in 18 months from a history of losses and eroding capital. Increased revenue by $100k by implementing new programs, while reducing the expense ratio over 100 bps.

Bank Examiner

FDIC

2002-2005

Examined large and small financial institutions for safety and soundness and consumer compliance. Assisted in financial analysis classes in Washington, D.C., for new examiners. Examined large institutions and shared national credits.

Several other financial analysis, teller, and customer service positions with credit unions prior to 2002.

Academic

MIT Sloan School of Management

Digital Transformation

Washington State University

Executive Masters of Business Administration

The University of Oklahoma

Bachelors of Business Administration Finance

Board Appointments

Board of Directors

- Cornerstone League (2020 - 2021)

- CUNA CEO Council EC (2018 - 2021)

- Kansas City Big Brothers/Big Sisters (2016-2018)

- Kansas City Area Development Council (2016-2018)

- Swope Community Builders (2013-2018) - Chair

Advisory Board & Committees

- Allied Solutions, LLC ( 2019 - 2021)

- ALM First Financial Advisors (2019 - 2021)

- Filene Research Institute (2016 - 2021)

- Regional Econ. Development Committee (2020-2021)