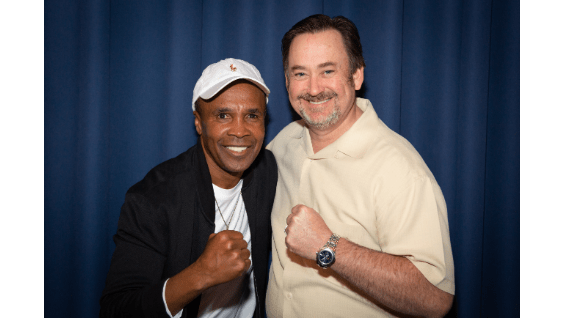

Greg W. Anderson

CEO and founder of Balanced Financial Inc.

Introducing Fort Collins' Greg W. Anderson

Greg Anderson, RICP, CEA is a recognized business person and financial services qualified professional. Anderson lives and works in the Fort Collins location of Colorado, where he serves as the CEO and founder of a financial firm. He possess 18 years of expertise within the personal financial niche, having entered a variety of duties during his employment. Mr. Anderson is RICP certified and is masterful at producing his business's prospects with progressive retirement venture guidance. He differs from other finance aides because he focuses on affordable financial investments that perform. Put simply, he is non-traditional in the sense that he helps his patrons away from low upside investments that fail to have long-lasting productivity. Retirement planning is one of his aspects of specialty, and he appeals to retiring planning with a rejuvenating new opportunity. Clients have the ability to gather and continue to keep value in their bank accounts, yet have the ability to keep profitability in order to take advantage of materializing assets opportunities. Low upside choices are utterly not a component of Greg's advisory abilities. With his guidance and guidance, many clients have achieved sturdy, comfortable fiscal futures.

Mr. Anderson continues on to investigate new opportunities in business and in committing. With his function at Balanced Financial and directorship both in establishment and in community-oriented organizations, he has limited downtime. When he has the ability to escape everything, Greg allots as much time as he can taking pleasure in traveling and outdoor journeys beside his spouse and teenagers.

Greg is a graduate of Colorado State University. Shortly after completing his undergraduate schooling, Greg decided to help a commercial realty developer in CO, granting him insight to sophisticated projects and the comprehensive dissections that go into said activities. This established the structure of his after occupation and furnished him with the techniques he needed to have to thrive. Shortly following departing the development job, he forged ahead with his own unique business, that of Balanced Financial, Inc in Fort Collins. Greg has a skill for comprehending all facets of the financial services niche, allowing his patrons focus on investments that manufacture returns accross the short & long terms.

What is Financial Preparation as well as Evaluation (FP&A)?

Financial Preparation and Evaluation (FP&A) teams play a crucial role in firms by carrying out budgeting, projecting, and evaluation that supports the CFO, CEO, and the Supervisors' significant corporate decisions.

Extremely few, if any, companies can be consistently successful as well as expand without cautious economic preparation and capital management. The task of handling a company's cash flow typically is up to its FP&A team and also its Chief Financial Officer (CFO). Find out more regarding the duty of the CFO.

What is FP&A? Layout

Corporate financial planning and monetary expert experts utilize both quantitative and qualitative evaluation of all operational elements of a firm to examine the business's progress toward attaining its goals and map out future objectives and strategies. FP&An Experts consider financial and business fads, testimonial past firm performance, and attempt to expect barriers as well as prospective issues, all to forecast a firm's future financial results.

FP&A specialists oversee a wide variety of economic events, including income, expenditures, tax obligations, capital investment, investments, as well as financial statements. Unlike accountants who supervise recordkeeping, economic analysts are charged with checking out, examining, examining the totality of a company's financial tasks, and even drawing up the company's financial future.

Financial experts are good trouble solvers. They can understand the different puzzle pieces that constitute a business's financial resources as well as picture placing the pieces together to create a variety of feasible growth scenarios.

Estate-Planning Concepts that Function

There are numerous factors for not experiencing this task. When they reach those gold years, some assume that there will certainly not suffice handed over to get ready for. Others believe their receivers can exercise the details.

Action 1: Construct Your Estate-Planning Group Among one of the most vital decisions, you'll make worrying your estate is who will lead you using this procedure. This team generally contains four people: a lawyer, a tax obligation commitment professional, a financial investment professional, and you-- select specialists in whom you have a miraculous positive self-image and do not hesitate to ask queries.

Activity 2: Determine Your Objectives Estate preparing concentrates on planning for life-- your life along with the lives of your fans. Estate preparation contains monetary along with, likewise, tax commitment worries. Nonetheless, it also includes aiding to ensure a loved one is safe. An added essential element of determining your purposes is making sure that your remedy stays to run successfully if you do pass away.

Task 3: Produce a Listing of Your Residences To help you develop an optimal estate plan, your team needs to have a specific checklist of the properties you possess. This includes your safeguarded retired life and, similarly, any tools that are real properties at your companies, such as cars, devices, etc.

Ask your legal representative, financial investment expert, in addition to furthermore accounting professionals, if they can offer documents that will assist provide your building or industrial buildings.

Idea 4: Reduce Tracking Information Cleaning up an estate can include a battery of documents. Resolve your properties, along with furthermore preserve a complete supply of these points. This will offer your survivors with the details called for to re-register any safeties.