Joe Biden warns of Delta after US added 943.000 jobs in July

President Joe Biden on Friday touted the country's economic recovery from the coronavirus pandemic after the US added 943,000 jobs in July and the unemployment rate fell to 5.4%, but said more work needs to be done to vaccinate the rest of the country amid the Delta variant surge.

"My message today is not one of celebration. It's one to remind us we have a lot of hard work left to be done, both to beat the Delta variant and to continue our advance of economic recovery," Biden said, speaking from the White House.

But the President argued the strong July jobs numbers showed that his administration's policies were strengthening the economy amid a deadly pandemic that has lasted for about a year and a half.

"Now while our economy is far from complete, and while we undoubtedly will have ups and downs along the way as we continue to battle the Delta surge of Covid, what is indisputable now is this: The Biden plan is working. The Biden plan produces results, and the Biden plan is moving the country forward," Biden said.

Joe Biden touts economic recovery but warns of Delta after US added 943,000 jobs in July

https://developer.torontopearson.com/node/10645

https://developer.torontopearson.com/node/10649

https://developer.torontopearson.com/node/10651

https://developer.torontopearson.com/node/10654

https://developer.torontopearson.com/node/10669

https://developer.torontopearson.com/node/10671

https://developer.torontopearson.com/node/10672

https://developer.torontopearson.com/node/10677

https://developer.torontopearson.com/node/10685

https://developer.torontopearson.com/node/10689

https://developer.torontopearson.com/node/10693

https://developer.torontopearson.com/node/10695

The July jobs report released by the Bureau of Labor Statistics Friday showed the biggest jobs gain since August of last year, when more than 1 million positions were added back. It was more than the 870,000 jobs economists had expected.

Some 253,000 jobs were added in restaurants and bars alone last month. The hospitality and leisure industries, which were decimated by Covid-19 lockdown measures, were once again the biggest contributors of job gains.

The June jobs gains were revised up as well, to 938,000 positions added, showing the recovery's strong pace over the summer.

https://developer.torontopearson.com/node/10701

https://developer.torontopearson.com/node/10706

https://developer.torontopearson.com/node/10711

https://developer.torontopearson.com/node/10714

https://developer.torontopearson.com/node/10726

https://developer.torontopearson.com/node/10728

https://developer.torontopearson.com/node/10730

https://developer.torontopearson.com/node/10734

https://developer.torontopearson.com/node/10736

https://developer.torontopearson.com/node/10739

https://developer.torontopearson.com/node/10741

https://developer.torontopearson.com/node/10745

Biden also touted the massive $1.2 trillion bipartisan infrastructure bill, called the Infrastructure Investment and Jobs Act, which would enact key elements of Biden's economic agenda. The President argued the package, which is currently making its way through the Senate, would make key investments in communities across the nation and further boost the US economy and its competitiveness.

The President said the Delta variant is "taking a needless toll on our country," primarily among unvaccinated Americans, and urged Americans to get the shot.

"Today about 400 people will die because of the Delta variant in this country. A tragedy, because virtually all of these deaths were preventable if people had gotten vaccinated," Biden said.

https://developer.torontopearson.com/node/10764

https://developer.torontopearson.com/node/10767

https://developer.torontopearson.com/node/10770

https://developer.torontopearson.com/node/10775

https://developer.torontopearson.com/node/10781

https://developer.torontopearson.com/node/10782

https://developer.torontopearson.com/node/10787

https://developer.torontopearson.com/node/10789

https://developer.torontopearson.com/node/10794

https://developer.torontopearson.com/node/10798

https://developer.torontopearson.com/node/10801

https://developer.torontopearson.com/node/10807

https://developer.torontopearson.com/node/10809

Many Americans have not gotten vaccinated, and the White House has been working to conduct outreach and combat misinformation running rampant about the vaccines.

But the President said the national vaccination effort had protected the population from the worst of the Delta variant spread.

"Because of our success with the vaccination effort, this new Delta variant wave of Covid-19 will be very different," Biden said.

Still, the President cautioned: "Cases are going to go up before they come back down. It's a pandemic of the unvaccinated."

https://developer.torontopearson.com/node/10859

https://developer.torontopearson.com/node/10861

https://developer.torontopearson.com/node/10865

https://developer.torontopearson.com/node/10871

https://developer.torontopearson.com/node/10872

https://developer.torontopearson.com/node/10874

https://developer.torontopearson.com/node/10878

https://developer.torontopearson.com/node/10881

https://developer.torontopearson.com/node/10884

https://developer.torontopearson.com/node/10885

https://developer.torontopearson.com/node/10892

https://developer.torontopearson.com/node/10895

https://developer.torontopearson.com/node/10896

Half of the US population is fully vaccinated against Covid-19, according to White House Data Director Dr. Cyrus Shahpar.

In a tweet on Friday, Shahpar said that more than 821,000 doses had been reported administered over the previous day's total, including about 555,000 people who got their first shot.

The US has seen a rise in cases recently, fueled by the Delta variant, but Covid-19 vaccinations have also been ticking up in recent days.

According to the latest data available from the CDC dashboard, an average of 699,261 doses have been administered each day over the past seven days, and an average of 464,778 people initiated vaccination each day over the past seven days.

https://developer.torontopearson.com/node/10905

https://developer.torontopearson.com/node/10906

https://developer.torontopearson.com/node/10907

https://developer.torontopearson.com/node/10910

https://developer.torontopearson.com/node/10917

https://developer.torontopearson.com/node/10918

https://developer.torontopearson.com/node/10928

https://developer.torontopearson.com/node/10929

https://developer.torontopearson.com/node/10931

https://developer.torontopearson.com/node/10936

https://developer.torontopearson.com/node/10941

https://developer.torontopearson.com/node/10942

https://developer.torontopearson.com/node/10950

https://developer.torontopearson.com/node/10953

On Thursday evening, Senate Majority Leader Chuck Schumer moved to cut off debate on the bipartisan infrastructure bill, paving the way for swift passage of the sweeping legislation.

The bill features $550 billion in new federal spending over five years and represents a major bipartisan achievement that will allow both parties to claim victory.

The plan invests $110 billion in funding toward roads, bridges and major projects, $66 billion in passenger and freight rail, $65 billion to rebuild the electric grid, $65 billion to expand broadband Internet access, $39 billion to modernize and expand transit systems and $7.5 billion to create the first federal network of charging stations for electric vehicles. The bill additionally includes $55 billion for water infrastructure, $15 billion of which will be directed toward replacing lead pipes.

https://developer.torontopearson.com/node/10960

https://developer.torontopearson.com/node/10964

https://developer.torontopearson.com/node/10966

https://developer.torontopearson.com/node/10969

https://developer.torontopearson.com/node/10973

https://developer.torontopearson.com/node/10975

https://developer.torontopearson.com/node/10980

https://developer.torontopearson.com/node/10986

https://developer.torontopearson.com/node/10989

https://developer.torontopearson.com/node/10991

https://developer.torontopearson.com/node/10998

https://developer.torontopearson.com/node/11001

https://developer.torontopearson.com/node/11004

https://developer.torontopearson.com/node/11008

US employers added 943,000 jobs in July, signaling a strong labor market

The US economy added 943,000 jobs in July and the unemployment rate fell to 5.4% — a new low of the pandemic era — the Bureau of Labor Statistics reported Friday.

It was the biggest job gain since August last year, when more than 1 million positions were added back, and more than the 870,000 economists had expected.

https://developer.torontopearson.com/node/11016

https://developer.torontopearson.com/node/11022

https://developer.torontopearson.com/node/11024

https://developer.torontopearson.com/node/11030

https://developer.torontopearson.com/node/11036

https://developer.torontopearson.com/node/11045

https://developer.torontopearson.com/node/11048

https://developer.torontopearson.com/node/11054

https://developer.torontopearson.com/node/11056

https://developer.torontopearson.com/node/11064

https://developer.torontopearson.com/node/11068

https://developer.torontopearson.com/node/11072

https://developer.torontopearson.com/node/11078

https://developer.torontopearson.com/node/11081

The June jobs gains was revised up as well, to 938,000 positions added, showing the recovery's strong pace over the summer.

"I have yet to find a blemish in this jobs report," wrote Harvard economist Jason Furman on Twitter (TWTR).

Since May 2020, America has added back 16.7 million jobs. But it's still 5.7 million short of its pre-pandemic level.

US job market recovery is underway

The United States lost 22 million jobs in March and April of 2020. By July 2021, over half of the lost jobs had been recovered.

https://developer.torontopearson.com/node/11090

https://developer.torontopearson.com/node/11093

https://developer.torontopearson.com/node/11095

https://developer.torontopearson.com/node/11099

https://developer.torontopearson.com/node/11105

https://developer.torontopearson.com/node/11107

https://developer.torontopearson.com/node/11110

https://developer.torontopearson.com/node/11112

https://developer.torontopearson.com/node/11116

https://developer.torontopearson.com/node/11120

https://developer.torontopearson.com/node/11126

https://developer.torontopearson.com/node/11127

https://developer.torontopearson.com/node/11131

President Joe Biden on Friday touted the success of his administration's economic policies but tempered his message saying "we doubtlessly will have ups and downs along the way as we continue to battle the Delta surge of Covid."

Still a long way to go

The hospitality and leisure industries — decimated by lockdown measures last year — were once again the biggest contributors of job gains, accounting for more than a third of the total. Some 253,000 jobs were added in restaurants and bars alone last month.

While the rampant growth is great news, the industry is still down 1.7 million jobs since February last year.

https://developer.torontopearson.com/node/11144

https://developer.torontopearson.com/node/11147

https://developer.torontopearson.com/node/11149

https://developer.torontopearson.com/node/11159

https://developer.torontopearson.com/node/11161

https://developer.torontopearson.com/node/11163

https://developer.torontopearson.com/node/11166

https://developer.torontopearson.com/node/11168

https://developer.torontopearson.com/node/11171

https://developer.torontopearson.com/node/11173

https://developer.torontopearson.com/node/11176

https://developer.torontopearson.com/node/11181

https://developer.torontopearson.com/node/11183

https://developer.torontopearson.com/node/11188

Hiring also picked up in eduction, according to the seasonally adjusted data. But the labor bureau warned that because hiring and layoffs in education were so distorted by the pandemic, the adjusted data might overstate the hiring in July.

Average hourly earnings rose for the fourth month in a row, adding 11 cents to $30.54, as the high demand for workers is pressuring companies to pay more to attract staff.

The jobless rate fell to its lowest level since the pandemic started, declining across nearly all demographic groups counted in the survey.

https://developer.torontopearson.com/node/11197

https://developer.torontopearson.com/node/11198

https://developer.torontopearson.com/node/11204

https://developer.torontopearson.com/node/11208

https://developer.torontopearson.com/node/11212

https://developer.torontopearson.com/node/11215

https://developer.torontopearson.com/node/11217

https://developer.torontopearson.com/node/11220

https://developer.torontopearson.com/node/11226

https://developer.torontopearson.com/node/11230

https://developer.torontopearson.com/node/11232

The unemployment rate for Black teenagers jumped by four percentage points to 13.3%.

The labor force participation rate inched up to 61.7%, while the employment-population ratio increased to 58.4%. Both measures are still below their February 2020 level.

"The stagnant participation rate confirms that there are millions of potential workers who are still outside the labor force, not currently looking for work and therefore not counted among the unemployed," said Cailin Birch, global economist at The Economist Intelligence Unit.

That said, nearly a million people found work in July, and that's a good sign for both the jobs recovery and consumer spending, which the US economy needs to grow, Birch said.

https://developer.torontopearson.com/node/11243

https://developer.torontopearson.com/node/11245

https://developer.torontopearson.com/node/11249

https://developer.torontopearson.com/node/11251

https://developer.torontopearson.com/node/11255

https://developer.torontopearson.com/node/11260

https://developer.torontopearson.com/node/11262

https://developer.torontopearson.com/node/11265

https://developer.torontopearson.com/node/11270

https://developer.torontopearson.com/node/11273

The pandemic recovery has been defined by a mismatch between businesses' demand for staff and workers' ability and willingness to go back out there amid childcare issues, virus fears and generous benefits.

Fed implication and Delta risk

For the Federal Reserve, which has been touting that it needs to see more improvements in the labor market before adjusting its policies, the July jobs numbers are just what the doctor ordered.

Even though the central bank doesn't seem to be in a rush to end its easy money policies, the sustained summer job growth is an important piece of the puzzle. In June, the Fed's consensus projections showed an interest rate hike in 2023, while it is widely expected it will start to taper its monthly asset purchases before then.

https://developer.torontopearson.com/node/11278

https://developer.torontopearson.com/node/11284

https://developer.torontopearson.com/node/11287

https://developer.torontopearson.com/node/11289

https://developer.torontopearson.com/node/11291

https://developer.torontopearson.com/node/11295

https://developer.torontopearson.com/node/11298

https://developer.torontopearson.com/node/11301

https://developer.torontopearson.com/node/11306

https://developer.torontopearson.com/node/11308

https://developer.torontopearson.com/node/11311

https://developer.torontopearson.com/node/11314

Correspondingly, the US stock market was mixed Friday as investors digested the good economic news along with the possible policy implications.

On top of that, there's a new hurdle in the path of the labor recovery: The Covid-19 Delta variant has brought back restrictions on public life in some places in the nation, and the Centers for Disease Control and Prevention updated its mask guidance for those who have been vaccinated.

So far, the increased virus spread from Delta has not weighed on the jobs data much, but that could change in the next reports.

https://developer.torontopearson.com/node/11324

https://developer.torontopearson.com/node/11326

https://developer.torontopearson.com/node/11329

https://developer.torontopearson.com/node/11332

https://developer.torontopearson.com/node/11335

https://developer.torontopearson.com/node/11341

https://developer.torontopearson.com/node/11343

https://developer.torontopearson.com/node/11345

https://developer.torontopearson.com/node/11349

https://developer.torontopearson.com/node/11352

https://developer.torontopearson.com/node/11355

https://developer.torontopearson.com/node/11356

Analysis: Where will yields go? Investors weigh U.S. jobs data against Delta fears

An unexpectedly strong jobs number for July has bolstered the case for investors who believe Treasury yields will head higher over the rest of the year, potentially weighing on an equity rally that has taken stocks to record highs.

Yields on the benchmark 10-year Treasury, which move inversely to prices, stood at about 1.3% on Friday, their highest level since July 23, after Labor Department data showed the U.S. economy added 943,000 jobs last month. Analysts polled by Reuters forecast payrolls adding 870,000 jobs. read more

https://developer.torontopearson.com/node/11365

https://developer.torontopearson.com/node/11369

https://developer.torontopearson.com/node/11371

https://developer.torontopearson.com/node/11374

https://developer.torontopearson.com/node/11378

https://developer.torontopearson.com/node/11382

https://developer.torontopearson.com/node/11385

https://developer.torontopearson.com/node/11386

https://developer.torontopearson.com/node/11391

https://developer.torontopearson.com/node/11395

https://developer.torontopearson.com/node/11396

Some investors believe the robust jobs numbers could support the view that the Federal Reserve, faced with rising inflation and strong growth, may need to unwind its ultra-easy monetary policies sooner than expected. Such an outcome could push yields higher while denting growth stocks and other areas of the market.

That view, however, is complicated by worries over rising COVID-19 cases across the United States that threaten to weigh on growth and the Fed’s insistence that the current surge in inflation is transitory.

In any event, the data will likely ramp up investor focus on this month’s central bank symposium in Jackson Hole, Wyoming. And if August's job growth proves equally as torrid, the summer hiring spree would raise the stakes for next month’s Fed meeting, at which the central bank may outline its plans for rolling back monthly asset purchases. read more

https://developer.torontopearson.com/node/11433

https://developer.torontopearson.com/node/11437

https://developer.torontopearson.com/node/11439

https://developer.torontopearson.com/node/11443

https://developer.torontopearson.com/node/11444

https://developer.torontopearson.com/node/11448

https://developer.torontopearson.com/node/11452

https://developer.torontopearson.com/node/11455

https://developer.torontopearson.com/node/11457

https://developer.torontopearson.com/node/11461

https://developer.torontopearson.com/node/11465

https://developer.torontopearson.com/node/11466

The data “gives markets some sort of direction," said Simon Harvey, senior FX market analyst at Monex Europe. "It makes the upcoming Jackson Hole event and September's Fed event live.”

Among the implications of higher yields could be a drag on tech and growth stocks with lofty valuations, as rising interest rates erode the value of the longer-term cash flows that many growth stocks are valued on. Those stocks have rallied since yields began drifting lower in March, helping to lift broader markets. For example, five tech or tech-related names alone - Apple (AAPL.O), Microsoft (MSFT.O), Amazon (AMZN.O), Google parent Alphabet (GOOGL.O) and Facebook (FB.O) - account for over 22% of the weight of the S&P 500.

https://developer.torontopearson.com/node/11469

https://developer.torontopearson.com/node/11472

https://developer.torontopearson.com/node/11475

https://developer.torontopearson.com/node/11478

https://developer.torontopearson.com/node/11483

https://developer.torontopearson.com/node/11487

https://developer.torontopearson.com/node/11490

https://developer.torontopearson.com/node/11491

https://developer.torontopearson.com/node/11496

Higher yields could also boost the appeal of so-called value stocks - shares of banks, energy firms and other economically sensitive companies that hurtled higher earlier in the year but have struggled in the last few months.

The Russell 1000 growth index (.RLG) has climbed about 18% since late March against a roughly 6% rise for its counterpart value index (.RLV).

The Dow Jones Industrial Average (.DJI) and S&P 500 (.SPX) posted record closing highs on Friday, rising 0.4% and 0.2%, respectively, while the tech-heavy Nasdaq (.IXIC) fell 0.4%.

https://developer.torontopearson.com/node/11503

https://developer.torontopearson.com/node/11506

https://developer.torontopearson.com/node/11508

https://developer.torontopearson.com/node/11511

https://developer.torontopearson.com/node/11514

https://developer.torontopearson.com/node/11519

https://developer.torontopearson.com/node/11522

https://developer.torontopearson.com/node/11527

https://developer.torontopearson.com/node/11530

https://developer.torontopearson.com/node/11532

https://developer.torontopearson.com/node/11533

https://developer.torontopearson.com/node/11537

Strong economic data that pushes up yields could pave the way for investors to move from growth companies to more economically-sensitive cyclicals, said Art Hogan, chief market strategist at National Securities in New York.

Strong data, though, could make dollar-denominated assets more attractive to yield-seeking investors, potentially boosting the U.S currency. A stronger dollar can be a headwind for U.S. exporters because it makes their products less competitive abroad, while hurting the balance sheets of domestic multinationals that must convert foreign earnings into dollars.

The dollar index rose 0.57% late on Friday, on track for its biggest daily gain since mid-July.

https://developer.torontopearson.com/node/11540

https://developer.torontopearson.com/node/11542

https://developer.torontopearson.com/node/11545

https://developer.torontopearson.com/node/11547

https://developer.torontopearson.com/node/11549

https://developer.torontopearson.com/node/11553

https://developer.torontopearson.com/node/11557

https://developer.torontopearson.com/node/11558

https://developer.torontopearson.com/node/11561

https://developer.torontopearson.com/node/11563

Goldman Sachs, BofA Global Research and BlackRock are among firms that have said yields will rise to near 2% by year-end -- an outcome that could be hastened if a strong economy pushes the Federal Reserve to begin unwinding its ultra-easy monetary policies sooner than expected. Others, like HSBC, have called for yields below current levels.

“We think the recovery in long-dated Treasury yields that has taken place over the past week or so is a sign of things to come,” analysts at Capital Economics said in a note published Friday.

“We suspect that growth in the US will be quite strong in the coming quarters, and that the recent surge in inflation there will prove far more persistent than most anticipate,” the firm said.

https://developer.torontopearson.com/node/11569

https://developer.torontopearson.com/node/11571

https://developer.torontopearson.com/node/11574

https://developer.torontopearson.com/node/11577

https://developer.torontopearson.com/node/11582

https://developer.torontopearson.com/node/11584

https://developer.torontopearson.com/node/11587

https://developer.torontopearson.com/node/11589

https://developer.torontopearson.com/node/11590

https://developer.torontopearson.com/node/11595

https://developer.torontopearson.com/node/11597

https://developer.torontopearson.com/node/11599

U.S. labor market powers ahead with strong job gains, lower unemployment rate

U.S. employers hired the most workers in nearly a year in July and continued to raise wages, giving the economy a powerful boost as it started the second half of what many economists believe will be the best year for growth in almost four decades.

The Labor Department's closely watched employment report on Friday also showed the unemployment rate dropped to a 16-month low of 5.4% and more people waded back into the labor force. The report followed on the heels of news last week that the economy fully recovered in the second quarter the sharp loss in output suffered during the very brief pandemic recession.

https://developer.torontopearson.com/node/11604

https://developer.torontopearson.com/node/11606

https://developer.torontopearson.com/node/11609

https://developer.torontopearson.com/node/11612

https://developer.torontopearson.com/node/11614

https://developer.torontopearson.com/node/11617

https://developer.torontopearson.com/node/11620

https://developer.torontopearson.com/node/11623

https://developer.torontopearson.com/node/11626

https://developer.torontopearson.com/node/11630

"We are charting new economic expansion territory in the third quarter," said Brian Bethune, professor of practice at Boston College in Boston. "The overall momentum of the recovery continues to build."

Nonfarm payrolls increased by 943,000 jobs last month, the largest gain since August 2020, the survey of establishments showed. Data for May and June were revised to show 119,000 more jobs created than previously reported. Economists polled by Reuters had forecast payrolls would increase by 870,000 jobs.

The economy has created 4.3 million jobs this year, leaving employment 5.7 million jobs below its peak in February 2020.

https://developer.torontopearson.com/node/11634

https://developer.torontopearson.com/node/11638

https://developer.torontopearson.com/node/11643

https://developer.torontopearson.com/node/11644

https://developer.torontopearson.com/node/11649

https://developer.torontopearson.com/node/11653

https://developer.torontopearson.com/node/11657

https://developer.torontopearson.com/node/11661

https://developer.torontopearson.com/node/11663

https://developer.torontopearson.com/node/11671

https://developer.torontopearson.com/node/11673

https://developer.torontopearson.com/node/11677

https://developer.torontopearson.com/node/11681

https://developer.torontopearson.com/node/11683

President Joe Biden cheered the strong employment report. "More than 4 million jobs created since we took office," Biden wrote on Twitter. "It's historic - and proof our economic plan is working."

Hiring is being fueled by pent-up demand for workers in the labor-intensive services sector. Nearly $6 trillion in pandemic relief money from the government and COVID-19 vaccinations are driving domestic demand.

But a resurgence in infections, driven by the Delta variant of the coronavirus, could discourage some unemployed people from returning to the labor force.

https://developer.torontopearson.com/node/11723

https://developer.torontopearson.com/node/11725

https://developer.torontopearson.com/node/11728

https://developer.torontopearson.com/node/11731

https://developer.torontopearson.com/node/11734

https://developer.torontopearson.com/node/11735

https://developer.torontopearson.com/node/11742

https://developer.torontopearson.com/node/11804

https://developer.torontopearson.com/node/11809

https://developer.torontopearson.com/node/11813

https://developer.torontopearson.com/node/11815

https://developer.torontopearson.com/node/11818

https://developer.torontopearson.com/node/11822

https://developer.torontopearson.com/node/11824

https://developer.torontopearson.com/node/11827

July's employment report could bring the Federal Reserve a step closer to announcing plans to start scaling back its monthly bond-buying program. The U.S. central bank last year slashed its benchmark overnight interest rate to near zero and is pumping money into the economy through the bond purchases.

"This is the last employment report Chair (Jerome) Powell sees before Jackson Hole, and we have to imagine that he lays the groundwork for a potential September tapering announcement," said Conrad DeQuadros, senior economic advisor at Brean Capital in New York. "We think the odds continue to rise that tapering begins before the end of 2021."

Stocks on Wall Street rose, with the Dow Jones Industrial Average (.DJI) and the S&P 500 (.SPX) index hitting record highs. The dollar (.DXY) jumped against a basket of currencies. U.S. Treasury prices fell. read more

https://developer.torontopearson.com/node/11830

https://developer.torontopearson.com/node/11835

https://developer.torontopearson.com/node/11838

https://developer.torontopearson.com/node/11841

https://developer.torontopearson.com/node/11845

https://developer.torontopearson.com/node/11847

https://developer.torontopearson.com/node/11852

https://developer.torontopearson.com/node/11854

https://developer.torontopearson.com/node/11862

https://developer.torontopearson.com/node/11864

https://developer.torontopearson.com/node/11868

https://developer.torontopearson.com/node/11871

https://developer.torontopearson.com/node/11876

BROAD EMPLOYMENT GAINS

Employment in the leisure and hospitality sector increased by 380,000 jobs, accounting for 40% of the job gains, with payrolls at restaurants and bars advancing by 253,000.

Government payrolls increased by a whopping 240,000 jobs as employment in local government education rose by 221,000. Education jobs were flattered by a seasonal quirk.

https://developer.torontopearson.com/node/13863

https://developer.torontopearson.com/node/13864

https://developer.torontopearson.com/node/13865

https://developer.torontopearson.com/node/13867

https://developer.torontopearson.com/node/13869

https://demingps.instructure.com/courses/5361/pages/dot-watch-dot-rick-and-morty-season-5-episode-8-online-full-episodes

https://demingps.instructure.com/courses/5361/pages/watch-dot-rick-and-morty-season-5-episode-8-online-full-episodes-hd

https://demingps.instructure.com/courses/5361/pages/full-episodes-rick-and-morty-season-5-episode-8-hd-online

https://demingps.instructure.com/courses/5361/pages/watch-rick-and-morty-season-5-episode-8-5x8-full-video-episodes

https://demingps.instructure.com/courses/5361/pages/watch-rick-and-morty-season-5-episode-8-online-full-hd-free

https://www.bulbapp.com/u/watch-rick-and-morty-season-5-episode-8-online-full-episodes

https://www.bulbapp.com/u/watch-rick-and-morty-season-5-episode-8-online-full-episodes-hd

https://www.bulbapp.com/u/full-episodes-rick-and-morty-season-5-episode-8-hd-online

https://www.bulbapp.com/u/watch-rick-and-morty-season-5-episode-8-5x8-full-video-episod

https://www.bulbapp.com/u/watch-rick-and-morty-season-5-episode-8-online-full-hd-free

https://www.bulbapp.com/analayah/portfolio

Hiring was also strong in the professional and business services, transportation and warehousing, and healthcare industries. Manufacturing payrolls increased by 27,000 jobs, while construction employment rebounded by 11,000 jobs. Retail trade and utilities were the only sectors to shed jobs.

Details of the smaller household survey from which the unemployment rate is derived were also upbeat. Household employment shot up by 1.043 million jobs, leading the unemployment rate to decline half a percentage point to its lowest level since March 2020.

https://notes.io/ZznE

http://paste.jp/1ce0db97/

https://controlc.com/6d64548c

https://paste.firnsy.com/paste/TsrlxM3Yu87

https://paiza.io/projects/C_KHiv8yhQFyOO3bbVCT7Q?language=php

https://jsfiddle.net/kepinajach/hveps9w4/

https://onlinegdb.com/c9XC4zApG

https://rentry.co/zhwhc

https://pastebin.com/p9L8pBXC

https://www.peeranswer.com/question/610df129e43e97cf4c364618

https://elouise.cookpad-blog.jp/articles/655694

https://www.getrevue.co/profile/joe-biden-warns-of-delta

The jobless rate, however, continued to be understated by people misclassifying themselves as being "employed but absent from work." Without this misclassification, the unemployment rate would have been 5.7% in July.

About 261,000 people entered the labor force, lifting the participation rate to 61.7% from 61.6% in June. The employment-to-population ratio, viewed as a measure of an economy's ability to create employment, rose to 58.4% from 58% in June.

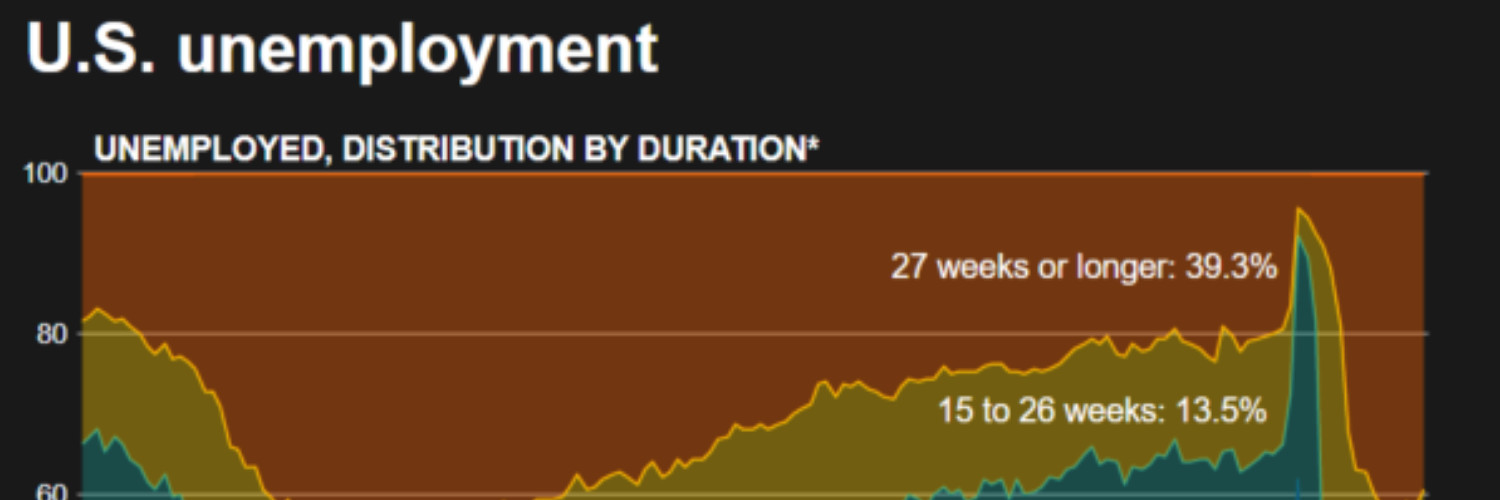

Even more encouraging, the number of long-term unemployed dropped to 3.4 million from 4 million in the prior month. They accounted for 39.3% of the 8.7 million officially unemployed people, down from 42.1% in June. The duration of unemployment fell to 15.2 weeks from 19.8 weeks in June.

There was also an improvement in the number of people who have permanently lost their jobs. With economic growth this year expected to be around 7%, which would be the fastest since 1984, further recovery is expected.

Faced with a record 9.2 million job openings, employers continued to raise wages to attract workers. Average hourly earnings increased 0.4% last month, with sharp gains in the hospitality industry. That followed a similar rise in June and lifted the year-on-year increase in wages to 4.0% from 3.7%.

Lack of affordable child care and fears of contracting the coronavirus have been blamed for keeping workers, mostly women, at home. There also have been pandemic-related retirements as well as career changes. Republicans and business groups have blamed enhanced unemployment benefits, including a $300 weekly payment from the federal government, for the labor crunch.

Half of the nation's states led by Republican governors have ended these federal benefits before their Sept. 6 expiration. Economists are cautiously optimistic that the worker shortage will ease in the fall when schools reopen for in-person learning and sustain the strong pace of hiring.

"August should be another big month, and September as well, as there are still millions who need to find work quickly," said Chris Low, chief economist at FHN Financial in New York.

Professional Background

- Current status

- Profession

- Fields

- Work experience

- Management

- Highest level of education

Job search preferences

- Desired job type

- Desired positions

- Desired work locations

- Freelance

Work Experience

No content as of now.

Education

No content as of now.