How to Answer Bank Interview Questions like a Professional

In this article, we'll cover:

If you wish to pursue a career in the finance world, you are spoilt for choice. There are a range of careers to consider with varying degrees of customer interaction. Banking institutions provide a range of opportunities, such as:

- Bank teller

- Credit analyst

- Investment banker

- Financial advisor

- Mortgage broker

- Corporate banker

Banking jobs involve a variety of skills and are also highly competitive. Therefore, being well-prepared for a banking interview will allow you to prove yourself as a competent professional who will represent the company well. Banking interview questions and answers will differ between bank roles, and each banking interview will have a unique twist depending on the sector. A combination of hard and soft skills are sought after in banking professionals, and in this article we will go over bank interview tips and examples so you can ace your banking interview.

General Banking Interview Questions

Banking Job Skills

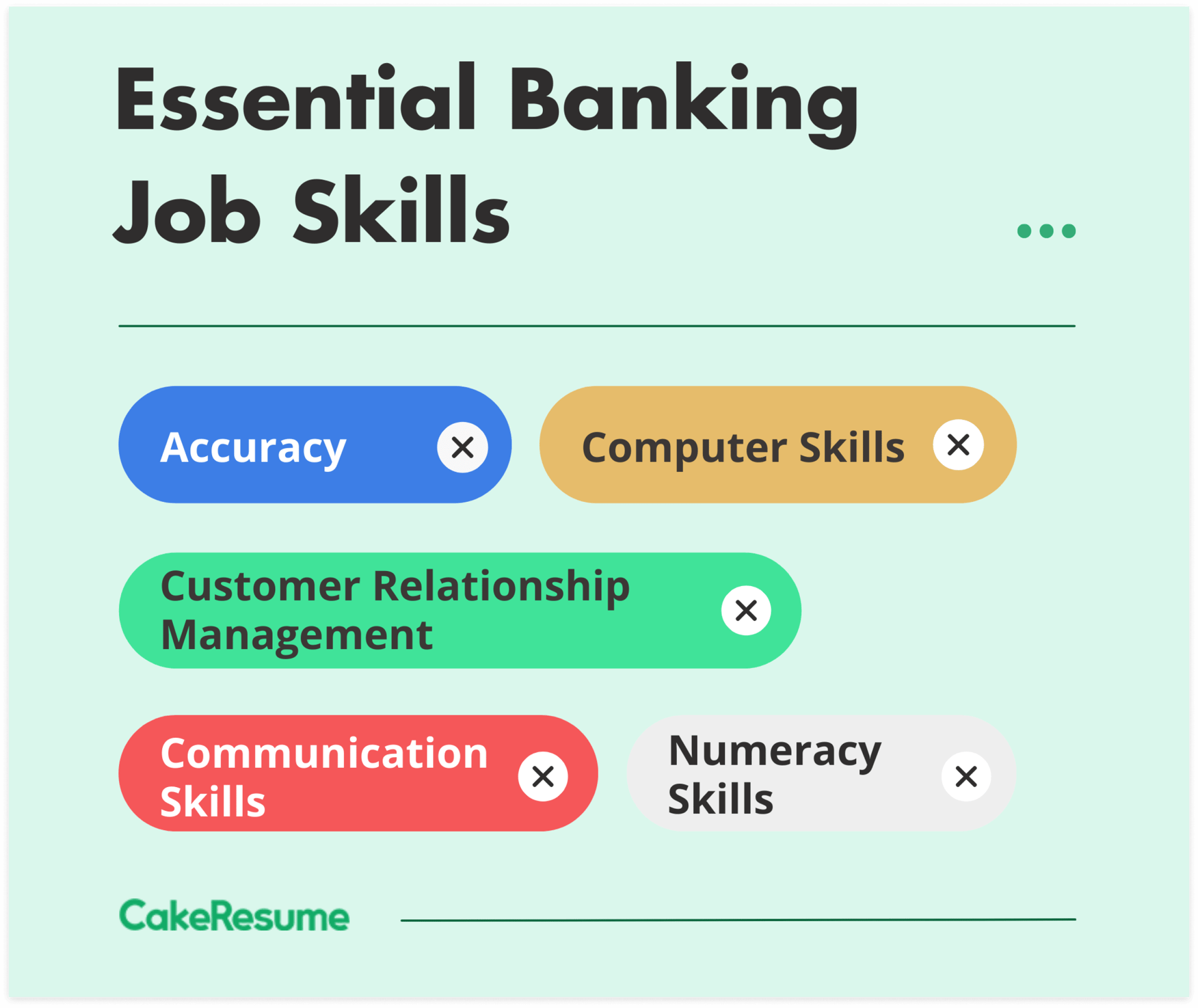

In bank interviews, interviewers are looking for professionals who can represent the bank and build rapport with clientele. Additionally, as banking is a numbers-focused profession, banking interviews will focus on how you can balance your use of both hard and soft skills. Banking interview questions will be rather explicit when reviewing your skills, so having genuine answers will make you appear prepared and committed. Common skills interviewers will be exploring in banking interview questions include:

- Accuracy: Banking jobs require you to recall information to relay to customers such as interest rates offered, types of accounts available as well as deposit and withdrawal limits. Therefore, banking interviews will test how you apply accuracy such as by error checking.

- Customer Relationship Management: Bank interview questions will focus on how you can place the customer as the top priority when providing banking services.

- Computer Skills: Banking services are available online and through bank branches, meaning you should be well versed in using banking related software. If you can, mention any software for finance, mathematics or accounting that you are familiar with in your banking interview.

- Numeracy Skills: Banking is a numbers-heavy profession, so having strong numeracy skills will not only make your job easier, but also help you stand out in a banking interview. Financial data in banking professions such as investments and stock market trading can change daily, so strong numerical comprehension will be tested especially in investment banking interviews.

- Communication Skills: Bank tellers, financial advisors and mortgage brokers will interact daily with customers of varying degrees of financial literacy. Your banking interview is an opportunity to portray your effective communication skills – remember this includes posture, tone, expression and speed as well!

Common Bank Job Interview Questions

Just like any other job interview, bank interview questions will likely start off with pleasantries and then ease into work-related questions. These general interview questions are still important to the interviewer, so having genuine answers will help you build rapport in your bank interview.

Examples of banking job interview questions include:

- Tell me about yourself.

- Why do you want to choose banking as a career?

- Why do you want this role in particular?

- What is your greatest strength & how do you apply it at work?

- Tell me about a time you handled a difficult customer.

- How do you find solutions to customer problems?

- How are 3 ways you provide excellent customer service?

- How do you provide customer service for clients of diverse backgrounds?

- How do you cope with stress in the work environment?

Banking Interview Questions and Answers

Banking interview questions will differ slightly depending on the role. Understanding exactly what the role involves will help you answer banking interview questions with confidence. Here we have compiled questions and answers to common bank interview questions by role:

❓ Bank Teller Interview Questions and Answers

Q: What experience do you have handling cash or large amounts of money?

As a bank teller, you will have to handle cash, cheques or make transfers of large sums of money, which can be overwhelming for some people. To answer this bank interview question, include any experience handling money, to show that you are capable of handling bank transactions.

A: In my previous sales role I was responsible for taking deposits from clients as a part of confirming their order in cash, cheques or electronic transfers. Cash was counted with a banknote counter and cheques were verified with ID, and stored in the company safe.

Q: Can you share with us how you cope with busy periods?

Bank interview questions will focus on ways in which you are able to multitask and deal with a large volume of customers. If you have never worked for a bank before, sharing how to prioritize and multitask during your bank interview will show that you are capable of the role.

A: During busy periods, I try to prioritize both customers and awaiting tasks. During busy periods or promotional periods in my last role, we had lines of customers stretching out of the store. Providing high-quality service involved delegating tasks and focusing on providing for customers within a reasonable time frame.

Q: how do banks make money?

Any bank interview will ask a variation of this question. Banking interview questions are a mix of showcasing skills and having relevant industry knowledge. Having a detailed answer to this bank interview question will show the interviewer that you have relevant knowledge that you can apply to banking roles.

A: Banks earn profit in many ways, such as accepting deposits, interest on loans, interest spread, the banking value chain, as well as service charges such as sign-up fees, online payments and maintenance fees.

❓ Investment Banker Interview Questions and Answers

Q: What is the difference between a commercial and investment bank?

There is a clear difference between sectors of banking, and basic investment banking interview questions like these will test whether you have a relevant understanding of the fundamentals of investment banking.

A: Commercial banks take deposits and give loans to customers, which are calculated as assets on their balance sheet. Commercial banks make money from interest on loans and service fees. An Investment bank liaises between companies and investors, and by purchasing holdings, provides investments and advises on mergers & acquisitions.

Q: How is a company valued?

Investment banking interview questions will review your knowledge of key concepts of investment banking. Having a way to answer these questions in your own words will help you confidently navigate knowledge-heavy bank interviews.

A: There are three main ways a company is valued. First, we can use the Precedent Transaction Analysis, where we compare the company with similar companies in their industry to determine their worth. If that method doesn't suit, we can use the Comparable Company Analysis to assess the company’s value as a whole, including variables like their price to earnings and stock price instead of just the value of purchasing the company. Finally, we can also use the Discounted Cash Flow Analysis, where we consider the cash flow for the company over the coming years, and discount it at the rate it would return on investment.

Q: When would Direct Cash Flows not be appropriate in valuing a company?

This is a lead-on question from the one above. Banking interview questions will often prompt you to expand on concepts mentioned in other answers. Investment banking questions can be loaded, so lead-on questions are common. This not only provides a natural flow to the bank interview, but allows you to showcase your understanding further!

A: Direct Cash Flows would not be used if the company being valued is unpredictable or has unpredictable cash flows. Another situation is when working capital and cash flows have fundamentally different roles in a company, such as in banks that have debt as working capital.

❓ Loan Processor Interview Questions and Answers

Q: How do you reduce errors in your work, especially when working with numbers?

Although all bank interview questions will ask a variation of this question, you can use this as an opportunity to share what software or programs you are proficient in.

A: When initially reviewing customer paperwork, I make sure to thoroughly read through the data and confirm they are relevant and current. When handling loans for all my clients, I use loan processing software which will assist me in flagging unusual numbers. When this occurs I make sure I troubleshoot appropriately and review before making changes.

Q: Explain the difference between a Secured and Unsecured loan?

Testing basic knowledge is common across all banking interview questions, and will be asked in bank interviews to make sure you understand the concepts and can relay these to a customer if necessary.

A: A secure loan is one that includes collateral, such as a home, which the lender can hold until the loan is paid off in full. If the borrower fails to pay back the loan, the lender can take ownership of the collateral. An unsecured loan is one that does not have collateral, and the borrower can receive the loan outright, such as personal loans and credit cards. As there is no collateral involved, unsecured loans usually have higher interest.

Q: How do you explain loan information to clients?

As banks provide services to the public, the financial literacy and knowledge of clients will vary. Bank interviews want to focus on customer service questions as well, as you will be representing the bank.

A: First, I will have a call with the client to discuss the loan process of our bank. I will then ask basic questions about their finances and debt history to determine their experience with borrowing and suitability for a loan. I answer any questions clients have, and then will send a follow-up email to provide brochures, information or guides on loans. Finally, I will schedule an in-person meeting to further discuss the loan they decide on, and get the process started from there.

❓ Financial Advisor Interview Questions and Answers

Q: What keeps you motivated when maintaining rapport with customers?

Financial advisors will be heavily relied on by their clients, and need to maintain rapport and a professional relationship with them. This can become overwhelming, so showing how you use soft skills to retain customers will be seen favorably in bank interviews.

A: Seeing customers reach financial goals, make exciting financial decisions and receiving positive feedback keeps me motivated. Checking in with customers allows me to see how my assistance impacts their finances, and allows me to build and maintain relationships between clients and the bank.

Q: How would you handle a demanding customer, who pushes you to make unethical decisions?

Banking institutions are heavily regulated, and having integrity in your answers will be viewed favorably in your bank interview. Show how you can ease tense situations with customers when answering banking interview questions.

A: If a client is demanding, I will first discuss with them what their concerns are and explore the reasons why their demands are important to them. If they try to encourage me to act unethically, I will explain the reasons why doing so is not only illegal, but will not benefit their financial situation in the long run.

Q: How does your experience in finance make you a great fit for this role?

Bank interview questions will explore your relevant industry knowledge and background; but as financial advising can involve an array of banking operations, and having a diverse experience in technical and customer service roles can help you in your banking interview.

A: First, I have university-level education in finance and accounting, which led me to become a certified financial advisor. I have worked in customer-facing finance roles such as bank telling, as well as financial management roles such as wealth management and investing. I am proficient in accounting and investing software, and can apply knowledge from many different sectors of banking to any customers’ goals.

❓ Underwriter Interview Questions and Answers

Q: how do you cross-check clients’ banking information?

Bank interview questions for all roles will ask a question similar to this. Bank interview questions for underwriters will focus on accuracy, reliability and consistency.

A: To verify client information, I will cross-reference the credit reference bureaus, review their credit score and verify documents, asking for appraisals if necessary.

Q: How do you make judgements for cases where you feel uncertain?

Underwriters have to make decisions on approvals for loans, and occasionally the judgment can be uncertain. Uncertainty and risk will be mentioned in all bank interview questions, but are especially relevant here. When answering a question like this in your bank interview, have a process which sounds consistent and accurate.

A: When making a difficult judgment, I will review the analysis tools and software used, as well as background information on the client. I will assess the predicted risk of the case, and use future projections of the current economy as well as client history to determine if the risk is worthwhile.

Q: What situations will you turn down an application?

This bank interview question also tests your judgment, so have a clear answer which acknowledges policies and rules. This bank interview question will also test your understanding of fraud and default.

A: If I receive an application which is incomplete or improperly filled out, as well as an application with many question marks, I will reject it. Other situations which show the client as too high risk involve background checks including poor credit history, criminal history, history of default, and suspicions of fraud.

Questions to Ask During a Bank Interview

The interviewer will open up the discussion for you to ask questions in your bank interview. Being prepared will always be seen favorably, so here are example questions for you to ask in your bank interview:

- What advice would you give to entry-level employees at this bank?

- What is the career trajectory for this role?

- What is the current strategy for expansion?

- What are the bank's long-term goals?

- What is a typical day like for this role?

🔑 Key Takeaways

Depending on your role, banking interview questions will differ slightly. Bank interviews can involve a variety of questions, so although you might have the education or background in the banking industry, knowing how to answer bank interview questions will help you get ahead. Showcase your technical knowledge and soft skills in well-rounded answers, and prepare with our bank interview questions in this article.

Whether you’re an investment banker or bank teller, interview questions will get into the details of the industry in your bank interview, so it’s best to be prepared! Good luck!

With CakeResume, you can easily create a resume online, free download your resume in PDF, and utilize ATS-compliant templates to create a resume. Land your dream job, create your resume online (free download) now!

--- Originally written by Bronte McNamara ---

More Career and Recruitment Resources

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!