Banking Resume : Step-by-Step Writing Guide (with Examples)

You'll learn:

- Step 1: Make your bank resume well-laid-out.

- Step 2: Pick the right bank resume format.

- Step 3: Provide basic personal details and contact information.

- Step 4: Title your banking resume with an intriguing headline.

- Step 5: Polish an impressive banking resume summary.

- Step 6: Include skills and abilities relevant to the banking job.

- Step 7: Showcase experience along with accomplishments.

- Step 8: List educational qualifications and background.

- Step 9: Add an extra section to make your banking resume stand out.

- Step 10: Craft a job-winning bank cover letter.

- Bank Resume Sample

Banking jobs typically involve working for banks at the local, regional, or national level. There is a wide range of job titles found in public sector banks, such as bank teller, loan officer, mortgage consultant, investment representative, credit analyst, etc.

In general, their key responsibilities will include working closely with clients to determine their banking needs, discussing their financial requirements, providing financial advice, and collaborating with other banking professionals to ensure high-quality client service.

With so many people competing for the top banking jobs, an outstanding banking resume is an essential tool in your job hunt that can land your dream job.

Step 1: Make your bank resume well-laid-out.

First, let's check out the standard guidelines for a well-laid-out bank resume:

- Resume length:

You should only go for 1-2 pages unless you’re required to submit a banking CV.

A banking resume should be one page most of the time, whereas two-pages resumes are favored by professionals with 15+ years of experience who have achieved significant accomplishments in the field.

- Letter font:

Remember to use only easy-to-read fonts and keep them consistent throughout your banking resume!

As you're writing a banking resume, not a creative job, it's recommended that you stick to standard fonts such as Arial, Calibri, Cambria, Times New Roman, Georgia, or Helvetica. Keep the font consistent through your banking resume.

Regarding the font size, it’s ideal to set it at 10-12 pt for your name, job title, and 14-16 pt for section headings.

- Resume margin & spacing:

Margins on your banking resume should be 1-1.5 inches on all sides and 1.0-1.15 for line spacing. Feel free to adjust accordingly to balance white space and text.

- Save your documents correctly:

As a rule of thumb, save and submit your document as a bank teller resume pdf if there is no specific request in the job listing. That way, the formatting won’t get messed up when your banking resume and banking cover letter are opened on a different device.

❌ Don't forget to name the files properly - it can show your professionalism! Here’s a recommendation: [First Name] [Last Name] - [Job Role] Resume

CakeResume helps banker build professional resumes! Start from choosing a suitable resume template & layout, you can learn from our step-by-step guide to make a perfect banking resume for free.

Step 2: Pick the right bank resume format.

There are four common types of resume format: chronological, functional, combinational, and targeted. Depending on the job position and your level of experience, you can adopt a well-fitted resume format for a bank job.

Chronological resume format

Definition

Lists your work experience in a timely-reversed order: the most recent job listed at the top of the section and the first ones at the end.

The most common resume format used by job seekers.

Application

Suitable for professionals with extensive experiences, such as bank manager resume or assistant branch manager resume; or any individuals working for several years in the field.

Functional resume format

Definition

Focuses on your professional skills rather than work history and career progression.Optimizes the skills section with the use of bullet points and examples from both work and life experiences.

Application

Great for freshers, job seekers with employment gaps, and career changers with transferable skill sets.

E.g., entry-level banking resume or banking resume with no experience.

Combinational resume format

Definition

The hybrid version of chronological and functional resume format.

Highlights both work experience and relevant skills to capture the employer's attention.

Application

A good choice for junior or mid-level candidates such as a bank teller supervisor resume.

Combinational resume format

Definition

Is entirely customized for the specific position.

Features your skills and professional experience while matching them with the job requirements.

Application

Suits all job seekers.

Step 3: Provide basic personal details and contact information.

✅. Personal details in the banking resume provide essential information about you for the hiring manager. Thus, it's important to list sufficient and accurate personal details and contact information, including:

- Full name

- Phone number

- Address or location

- LinkedIn URL (optional)

❌ Don't include any of the following personal details in your banking resume and/or banking cover letter:

- Date of birth

- Sexual orientation

- Religion

- Race

- Marital status

- Expected/current salary

- National Insurance Number/Social Security Number

Step 4: Title your banking resume with an intriguing headline.

Resume headlines often go unattended, but you need to know that a catchy banking resume headline or title can help you stand out from other candidates and increase your chances of getting noticed.

A resume headline (also known as a resume title) is a short statement, no need to be a complete sentence, that sums up your expertise and professional experience.

Examples of a well-branded banking resume title:

- Bank customer service representative resume:

Bank Customer Service Representative providing customer support and account management at Vietcombank. - Investment banking resume:

Investment Banking Analyst with a proven record of potential sell-side and buy-side M&A deals. - Private banker resume:

Regional Private Banker with a focus in investments, loans, deposits and credit products for high net worth clients.

Check out 20+ Resume Headline Examples for a variety of jobs and positions.

Step 5: Polish an impressive banking resume summary.

The professional summary for a banking resume should be placed at the top and highlight your work experience, achievements, and skills. An impressive summary statement can fully attract the recruiter's attention - hooking them, reeling them in, and making them want to read the rest.

How to craft a great banking resume summary:

- Insert positive adjectives (experienced, enthusiastic, client-focused, data-driven, etc.)

- Include the job title

- Add years of experience and your core competencies

- Feature some key skills for bank jobs and/or outstanding achievements in the field

Resume summary v.s. Resume objective:

| Resume summaries are good for: | Resume objectives are good for: |

| - Experienced professionals - Individuals applying for multiple jobs at the same time | - Freshers - Job seekers with limited experience - Career changers - Applicants interested in a particular job opening |

Examples of a well-written summary statement for a banking resume:

Personal banker resume:

Personal Banker with 7 years of experience in providing thoughtful and trustworthy customer solutions and financial option exploration. Strong rapport with customers and associates based on comprehensive knowledge, high responsibility, and great professionalism.

Bank teller supervisor resume:

Top-performing Bank Teller Supervisor offering 10+ years of diversified experience. Adept at renovating personalized banking service and developing customer relationships. Committed to achieving customer satisfaction and organization reputation.

Bank branch manager resume:

Highly motivated Bank Manager with 15 years of experience developing high net worth client relationships and referral networks. Expertise in sales strategies/tactics, competitor intelligence, and personnel oversight. Top performer with a track record of driving sales and boosting company brand image.

Step 6: Include skills and abilities relevant to the banking job.

The skills section is where the hiring manager can get a clearer picture of your capabilities and determine whether you're the right fit.

How to list your banking skills so that they can see your USP (Unique Selling Points) successfully:

- Jot all banking skills you possess down in a list

- Pick the most relevant and outstanding ones (both hard and soft skills)

- Utilize bullet points to make this section easy to read

Hard skills

- Cash handling

- Bank security issues

- Risk and debt management

- Corporate accounting

- Tax compliance and planning

- Profit and loss accounts management

- Strategic planning and fund management

- Night and safe deposit systems

- Research & analysis skill

Soft skills

- Data-driven

- Detail-oriented

- Communication skills

- Organizational

- Time management

- Teamwork

- Critical thinking

- Problem solving

- Leadership

- Professional manner

Others skills

- Linguistic abilities

- Work well under pressure

- Maintain confidentiality when handling customer requests and transactions

- Work ethics

Step 7: Showcase work experience and accomplishments.

Here comes the most important part of your banking resume - work experience and achievements. This is where you really sell and promote yourself by showing the employer what tasks you handled and what accomplishments you achieved in the last jobs.

The standard format for this part is as follows:

- Job title

- Company name / Location

- Employment dates

- Job description: key responsibilities, outstanding achievements, and awards

Example of “Work Experience" in a bank customer service representative resume:

Bank Representative, Bank of America, Chicago

06/2015 - 10/2019

- Decreased average on-call wait-time by 30%, leading to the highest customer satisfaction rate among branches.

- Leverage organizational abilities, coupied with superior attention to detail to efficiently process 25+ transactions per hour.

💡 Tip: Let numbers tell the story! Try to add quantifiable accomplishments to make your banking resume more impressive and convincing.

Step 8: List educational qualifications and background.

For a resume for bank jobs, the education section is crucial as the hiring manager can see whether you have relevant educational background.

How to get it right? Just simply list as the following format:

- College/University name and location

- Degree and major

- Graduate year

📝 If you're a fresh graduate seeking the first job, you should put this section above your work experience and include any awards or GPA.

Step 9: Add an extra section to your banking resume.

So far that's all must-haves for a banking resume.

Still got more to show off? Go ahead to give your banking resume a boost with the some additional information such as:

- Certifications (e.g., CFA, CPA, CMA, FRM)

- Awards (Banker/Bank Teller of The Year, International Banker Award, Central Banking Award)

- References (with full name, title, and email)

Step 10: Craft a job-winning bank cover letter.

Last but not least, you should include a cover letter even if it isn't required. An excellent cover letter for bank jobs provides further detail that you cannot express through a banking resume or banking CV. Specifically, it shows how your banking skill set aligns with the position, what you can contribute to the organization, and why you want the job.

A professional banking cover letter should include:

- Contact details: Full name, Email, Phone number

- Introduction: Who you are, what position you're applying for, and how you heard about the job.

- Intention to apply: What motivates you to apply for the job and what you can bring to the team.

- Qualification: What makes you qualified for the job in terms of skills, experience, and accomplishments.

- Closing: Politely thank the hiring manager for their time and consideration.

Further reading: Dos & Don’ts of Writing a Cover Letter

Writing a resume seems to be struggling at first no matter what job you are involved in. The great thing is that it’s not as hard as you may think since you can refer to many great banking resume examples on the Internet.

Also, online resume builders like CakeResume offer thousands of built-in resume templates that can help you create one on your own in 10 minutes!

Bank Resume Sample

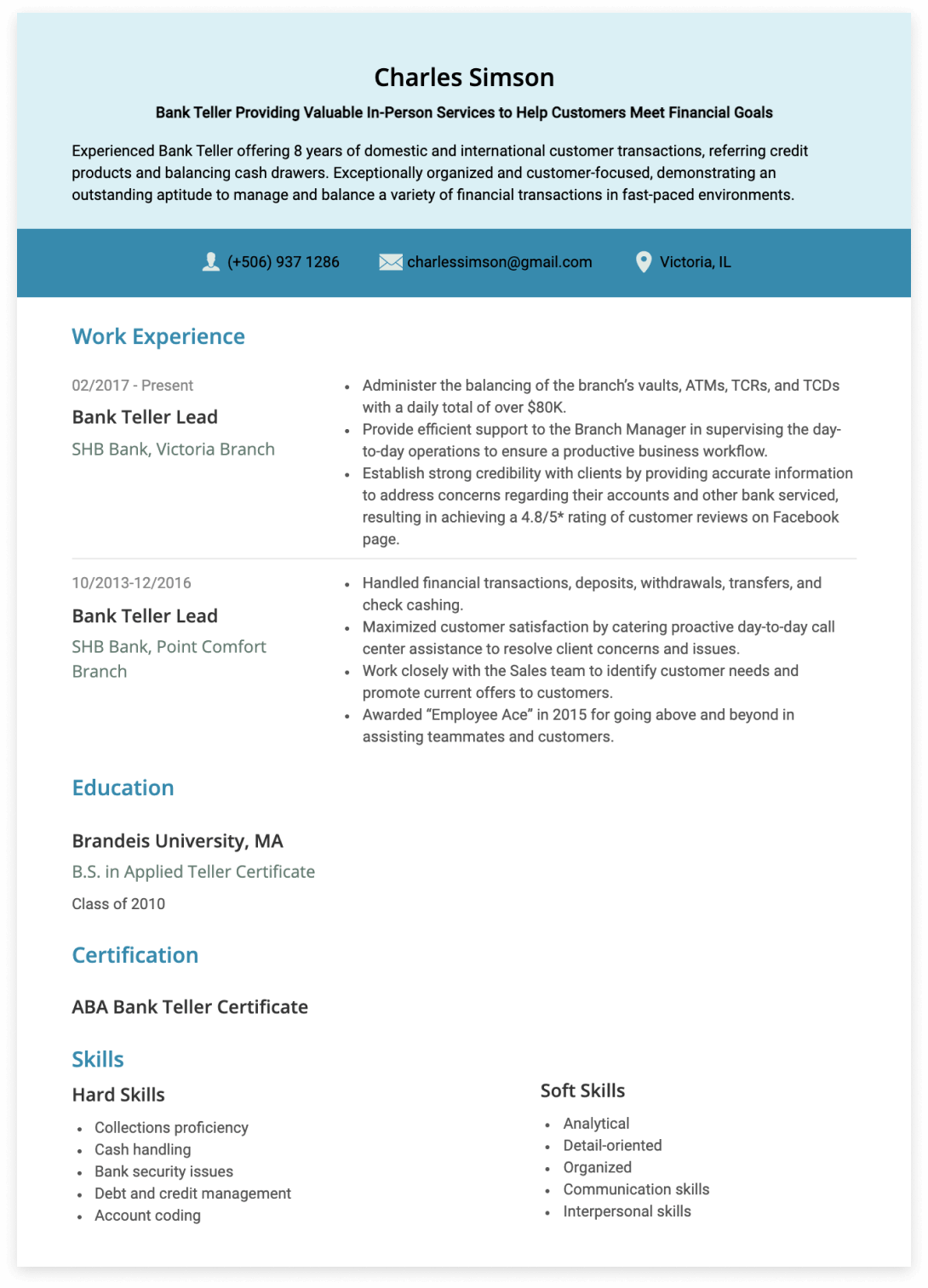

Charles Simson

Bank Teller Providing Valuable In-Person Services to Help Customers Meet Financial Goals

Phone: (+506) 937 1286

Email: [email protected]

Victoria, IL

Professional Summary

Experienced Bank Teller offering 8 years of domestic and international customer transactions, referring credit products and balancing cash drawers. Exceptionally organized and customer-focused, demonstrating an outstanding aptitude to manage and balance a variety of financial transactions in fast-paced environments.

Work Experience

Bank Teller Lead

SHB Bank, Victoria Branch

02/2017-Present

- Administer the balancing of the branch’s vaults, ATMs, TCRs, and TCDs with a daily total of over $80K.

- Provide efficient support to the Branch Manager in supervising the day-to-day operations to ensure a productive business workflow.

- Establish strong credibility with clients by providing accurate information to address concerns regarding their accounts and other bank serviced, resulting in achieving a 4.8/5* rating of customer reviews on Facebook page.

Bank Teller Lead

SHB Bank, Point Comfort Branch

10/2013-12/2016

- Handled financial transactions, deposits, withdrawals, transfers, and check cashing.

- Maximized customer satisfaction by catering proactive day-to-day call center assistance to resolve client concerns and issues.

- Work closely with the Sales team to identify customer needs and promote current offers to customers.

- Awarded “Employee Ace” in 2015 for going above and beyond in assisting teammates and customers.

Education

Brandeis University, MA

B.S in Applied Economics and Finance

Class of 2010

2013 - 2017

Certification

ABA Bank Teller Certificate

Skills

| Hard skills | Soft skills |

| Collections proficiency Cash handling Bank security issues Debt and credit management Account coding | Analytical Detail-oriented Organized Communication skills Interpersonal skills |

--- Originally written by May Luong ---

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!