Best Claims Adjuster Resume Examples & Template

You'll learn:

- 5 resume writing tips to help you land a claims adjuster job

- How to draft a killer objective for a claims adjuster resume?

- How to write a powerful resume summary for a claims adjuster job?

- Key skills for a claims adjuster resume that employers look for

- 5 know-hows for writing a claims adjuster resume with no experience

- Claims adjuster resume sample

Claims adjusters are in charge of the evaluation of insurance claims on behalf of an insurance company to determine who is liable.

They commonly get to the bottom of each claim by gathering information and compiling evidence from varied sources including claimants, witnesses, police reports, and medical records.

They also negotiate claim settlements and oversee whether claims have been paid out to policyholders.

🔎 Two major types of claims adjuster include:

- Staff adjusters who are salaried employees of an insurance company/agency or health insurance carrier.

- Independent claims adjusters who are independent contractors working for adjusting firms or government organizations.

Being a claims adjuster seems to be the most challenging job in the insurance industry but can be a highly rewarding role for the right person.

But first, you need to get it with a convincing claims adjuster resume.

5 resume writing tips to help you land a claims adjuster job

Tip 1: Create an ATS-friendly resume that beats the bot.

ATS (Applicant Tracking System) parses through text within your claims adjuster resume and imports key information into a profile—that’s how the system works and scans job applications that are qualified.

🙅 Note: While writing your own insurance claims adjuster resume, consider potential errors that may confuse ATS.

How to make your claims adjuster resume ATS-friendly:

- Adopt appropriate file formats, like PDF or Word

- Insert keyword from the claims adjuster job description

- Avoid graphics, tables, special symbols, etc.

Tip 2: Refer to claims adjuster resume examples on the Internet.

This is just like your job - consulting and gathering information from varied sources. Referring to online examples of claims adjuster resumes can be very helpful in writing a great resume and stand out from the crowd.

Besides, using a claims adjuster resume template is much more convenient compared to creating one by yourself.

Tip 3: Tailor your claims adjuster resume to the job ad.

Want the hiring manager to read your resume and think: “This person is perfect”? Well, it all begins there.

Claims adjuster jobs consist of various areas, hence, you need to tailor your resume to every job description and insert the right keywords. Make sure you have a grasp on the differences between a resume and a CV since resumes usually require more customization for the specific position.

Tip 4: Add numbers.

Draw the hiring manager's attention to the skills or work experience listed on your claims adjuster resume by presenting numbers.

This way, you can precisely demonstrate how you’ve used these skills and what you've achieved in the past.

Work achievement example of a senior claims adjuster resume:

❌ "Compiled accurate reports that display the status of active claims and pending payment."

✅ "Compiled 20+ reports per week regarding the status of active claims and pending payment with 100% accuracy."

Tip 5: Write a strong work experience section.

The bulk of your claims adjuster resume should be the work experience section where you describe each position you held earlier.

This section is also a great place to engage the employer with your job performance highlights and achievements.

Try to be as concise as possible!

Work experience example for an auto claims adjuster resume:

- Processed and resolved 80+ bodily injury claims, including total loss vehicle claims and catastrophe claims.

How to draft a killer objective for a claims adjuster resume?

It's not a strict requirement to include an objective statement on your resume for a claims adjuster job.

But if you fall in this group, you might need to think over:

- Entry-level job seekers

- Career changers

- Individuals with employment gaps

Career objective or resume objective acts as the pitch of your claims adjuster resume, stating your intention to seek employment and/or demonstrating your career goal.

Examples of an eye-grabbing claims adjuster resume objective:

- Entry-level insurance claims adjuster resume:

"Seeking a position in Singfor Life Insurance where my acquired knowledge and educational background will be utilized toward growth and advancement."

- Senior claims adjuster resume:

"Looking to join Mercuries Life Group to apply my 10 years of experience handling bodily injuries, auto, and special investigation claims."

- Property claims adjuster resume:

"Secure a career opportunity at SedgWick to fully utilize my skills and work experience in personal lines property claims, while achieving company goals."

Further reading: Resume objective writing tips for freshers & students

How to write a powerful resume summary for a claims adjuster job?

In some cases, you might notice that a resume summary is taking the place of an outdated resume objective.

A resume summary, also known as a personal statement, outlines the most impressive parts of your claims adjuster resume, while also serving to list any information that may not appear elsewhere on the page.

Examples of an intriguing claims adjuster resume summary:

- Entry-level insurance claims adjuster resume:

"Enthusiastic college graduate with an interest in insurance claims work. Efficient, multitasking, and detail-oriented with a solid understanding of insurance claims processing. Completed the Claims Processor Internship at Keritell Insurance Group."

- Senior claims adjuster resume:

"Highly experienced Claims Adjuster with 14+ years reviewing, evaluating insurance policies, and analyzing damages to determine fair coverage. Proven track record for negotiating claim settlements with third parties. Aim to provide the highest level of customer satisfaction while furthering the company’s mission and values."

- Auto claims adjuster resume:

"A result-oriented Auto Claims Adjuster with proven competencies in handling bodily injuries, complex property damage, and liability investigations. Excel at prioritizing, completing multiple projects, and following through to achieve company goals. Successfully investigated and resolved 200 claims in 3 states throughout the career."

👍 Note: Keep it brief within 4-5 sentences with pithy and straight-to-the-point fragments.

Key skills for a claims adjuster resume that employers look for

An outstanding claims adjuster resume, such as the sample you may read later, will highlight a number of impressive skills. A list of soft and hard skills associated with a claims adjuster position is best as the employer is seeking these abilities for an ideal candidate.

In general, there are 4 ways to structure the skills section on a resume. Read the skills formatting guide to learn more about their pros and cons.

Examples of convincing claims adjuster skills for a resume:

| ✅ Soft skills |

| - Communication Skills - Problem-Solving - Organization Skills - Customer Service Skills - Time Management |

| ✅ Hard skills |

| - Claims Processing - Policy Coverage - Knowledge of Insurance Policies - Knowledge of Laws - Legal Compliance |

CakeResume provides the right claims adjuster resume templates & formats for you to showcase your skills and experiences. Sign up to create and download the perfect resume now for FREE!

5 know-hows for writing a claims adjuster resume with no experience

👍 Advice 1: Pick the right claims adjuster resume format.

Not everyone knows how to select the well-fitted resume format, especially new grads and entry-level job seekers.

The right choice of format can make your content more accessible to the employer. When writing a claims adjuster resume with no experience, you may consider using a functional or hybrid resume format to highlight your skills instead of work experience.

👍 Advice 2: Draft a sincere career objective.

Including an objective statement will benefit your claims adjuster resume with no experience. As you don't have much relevant work experience to demonstrate, a sincere career objective can get you on the right track. It states what you’re looking to become and where you want to go on your career path.

Example of a career objective for a claims adjuster resume with no experience:

Looking for an entry-level claims adjuster position with Cathay Group that will utilize my excellent skills in resolving customer claims and achieving project goals.

👍 Advice 3: Highlight your educational background.

While writing the education section in a claims adjuster resume with no experience, remember to:

- Prioritize the education section over the work experience section to pique the hiring manager’s interest from the start.

- Don't need to add your high school if you've completed a higher degree.

- Follow the standard format:

- School name

- Type of degree

- Year of graduation

- GPA (if it's above 3.5) or awards

👍 Advice 4: Include relevant certifications or training courses.

As claims adjuster jobs don't require a specific major at college, you may want to showcase certifications or training courses related to the field. Below, you’ll find courses suitable for those seeking a claims adjuster certification, as well as all-line courses:

- Workers’ Compensation Claims Management Program

- Workers’ Compensation Specialists Certification

- Claims Adjuster Workforce Certificate

👍 Advice 5: Attach a claims adjuster cover letter.

Many of you may skip this as it's optional to submit a cover letter. However, as newbies seeking the first job, you should prepare one that demonstrates relevant skills and educational background, as well as a strong passion for this work. Also, take the opportunity to demonstrate that you’ve done your research on the company and the position.

✍🏻 Check out this cover letter guide to learn how to write a professional claims adjuster cover letter that lands the job.

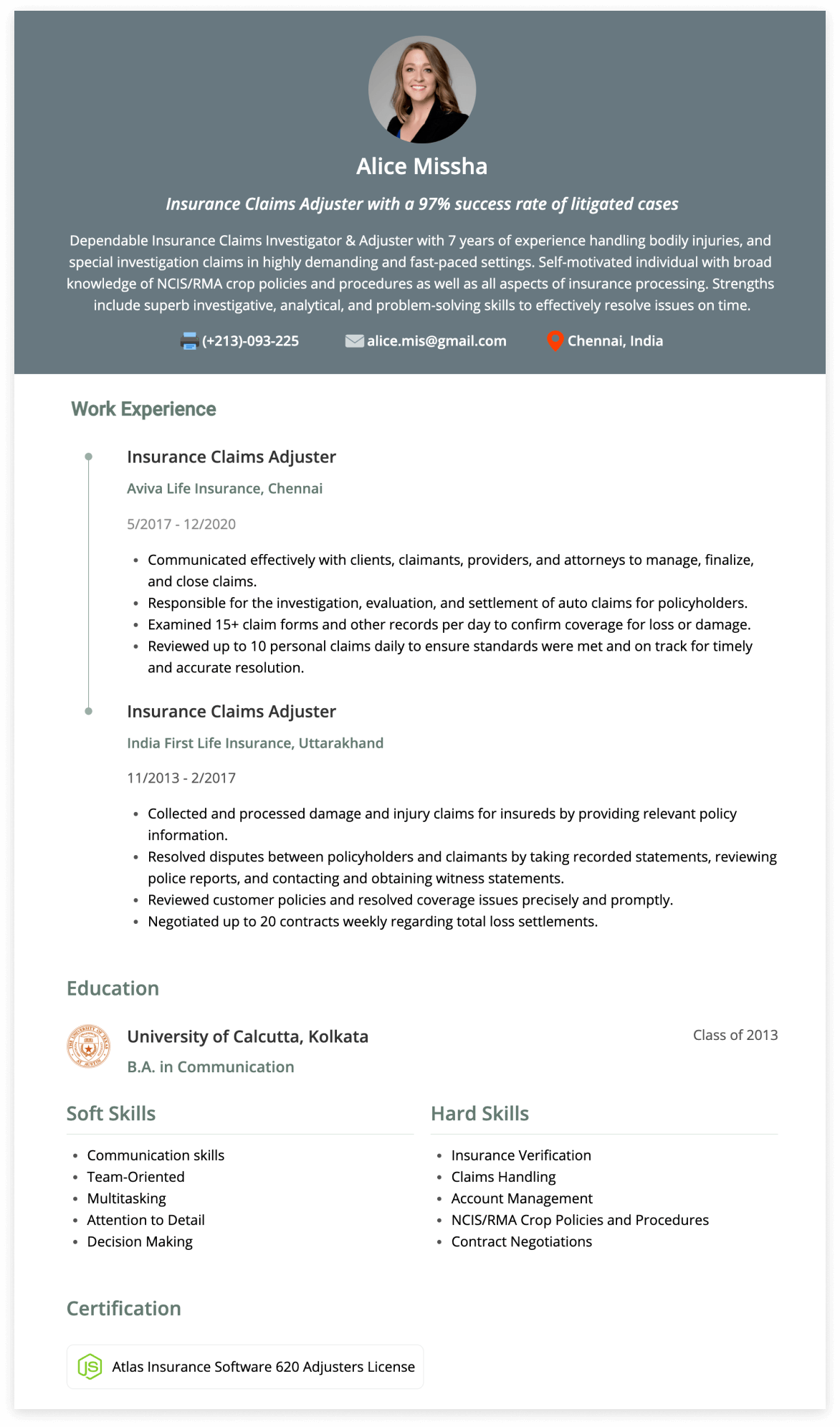

Claims adjuster resume sample

Alice Missha

Insurance Claims Adjuster with a 97% success rate of litigated cases

[email protected]

(+213)-903-225

Chennai, India

Professional Summary

Dependable Insurance Claims Investigator & Adjuster with 7 years of experience handling bodily injuries, auto, and special investigation claims in highly demanding and fast-paced settings. Self-motivated individual with broad knowledge of NCIS/RMA crop policies and procedures as well as all aspects of insurance processing. Strengths include superb investigative, analytical, and problem-solving skills to effectively resolve issues on time.

Work Experience

Insurance Claims Adjuster

Aviva Life Insurance, Chennai

5/2017 - 12/2020

- Communicated effectively with clients, claimants, providers, and attorneys to manage, finalize, and close claims.

- Responsible for the investigation, evaluation, and settlement of auto claims for policyholders.

- Examined 15+ claim forms and other records per day to confirm coverage for loss or damage.

- Reviewed up to 10 personal claims daily to ensure standards were met and on track for timely and accurate resolution.

Insurance Claims Adjuster

India First Life Insurance, Uttarakhand

11/2013 - 2/2017

- Collected and processed damage and injury claims for insured's by providing relevant policy information.

- Resolved disputes between policyholders and claimants by taking recorded statements, reviewing police reports, and contacting and obtaining witness statements.

- Reviewed customer policies and resolved coverage issues precisely and promptly.

- Negotiated up to 20 contracts weekly regarding total loss settlements.

Education

B.A. in Communication

University of Calcutta, Kolkata

Class of 2013

Skills

| Soft skills |

| Communication skills Team-Oriented Multitasking Attention to Detail Decision Making |

| Hard skills |

| Insurance Verification Claims Handling Account Management NCIS/RMA Crop Policies and Procedures Contract Negotiations |

Certifications

Atlas Insurance Software 620 Adjusters License

--- Originally written by May Luong ---

More Career and Recruitment Resources

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!