Collector Resume Examples, Templates & Formats

In this article, you'll learn:

Collectors, also known as collections agents or collections specialists, recover overdue payments on accounts. In general, they track debtors down by phone or mail and assist them to make payments by negotiating repayment plans or finding alternative payment solutions.

Job responsibilities of a collector:

- Setting debt collection strategies

- Leading the debt collection process for assigned customers

- Contacting customers to recover a debt or answer questions about billing statements

- Negotiating partial repayments and payment plans if necessary

- Collaborating with insurance companies and/or lawyers if legal action is required

Whatever collector jobs you’re seeking, be sure to prepare a top-notch collector resume to land the dream job. In this article, we will cover a wide range of collector jobs for your reference, including debt collector, collection agent, medical collector, etc.

5 tips for a job-winning collector resume

💡 Create an ATS-compliant resume to reach the employer.

You probably know that most companies are now ATS (Applicant Tracking System) to scan and discover well-matched applicants. Thus, creating an ATS-friendly collector resume is an effective way to increase your interview chances and shift the job search odds in your favor.

How to beat the bot?

- Stick to standard section headings (Education, Skills, Work Experience, etc.).

- Include the right keywords from the debt collector job description in your resume.

- Avoid graphs and fancy formatting.

- Submit the debt collector resume as PDF.

💡 Look up collector resume templates and examples online.

A lot of job search websites and online resume builders provide job seekers with many great resume templates and examples. This way, you can learn what a professional resume looks like and how to optimize the content for a good result.

💡 Tailor your collector resume for the role and use relevant keywords.

As there are specific types of debt, collector jobs have branched into several specific groups such as consumer collectors, commercial collectors, medical collectors, and government debt collectors.

Hence, when writing a collector resume, make sure you tailor it by going over the job ad carefully and adopting the right keywords to reach the right employer.

💡 Add numbers to your collection agent resume.

By showcasing measurable accomplishments on your collector resume, you can prove to hiring managers your ability to reach a goal within your former roles. This way they can see your value and evaluate your future contribution to the organization.

For example: “Accomplished collecting $18,000 from Allianz Life Insurance for 2018 claims.”

💡 Include job-related certifications.

Listing out certification(s) can yield some advantages - you not only demonstrate your theoretical knowledge and practical experience in the file but also impress hiring managers by showing them what other candidates may not have.

Top debt collector certifications to put on your resume:

- Certified Consumer Debt Specialists (CCDS)

- Credit and Collection Compliance Officer (CCCO)

- Certified Professional Collector (CPC)

- Certificate in Consumer Debt Collection (CertDC)

How to write a strong objective for a debt collector resume

The recruiter, when impressed by your resume objective, will be motivated to read through your entire debt collector resume.

So, how to nail it?

- Show your enthusiasm and professionalism by including career goals.

- Tailor the objective statement to the job you're applying for by mentioning the employer name and target position.

- Write no longer than 2 sentences.

Collector resume objective samples:

- Debt collector resume:

Looking to join THA Asset Inc. as a Debt Collector to speed the repayments of outstanding debts. - Medical collector resume:

Seeking a Medical Collector position at Avia Life to utilize my skills, knowledge, and experience in medical debt collections. - Collection agent resume:

To obtain the Collection Agent position in Zap Assets where I can further expand my strong negotiation skills and experience to ensure the optimal level of customer service.

You may want to check out resume objective examples for 20+ different jobs and professions from Career Objective for Resume|Samples, Formats, Writing Guide.

How to compile a professional collector resume summary

First of all, keep in mind that a resume summary is different from a resume objective.

A summary statement is longer than a resume objective, summarizing your skills, experience, and achievements in the field. It is believed to be a self-introduction to employers, so you should write it impressive and professional to pique their interest from the beginning.

Debt collector resume summary:

Debt Collector with 5+ years of experience in collections on unsecured loans, automobiles, and mobile homes. Fully knowledgeable in federal and state laws of collection regulations. Highly proficient in negotiating payoffs and settlements with customers while complying with the company guidelines.

Medical collector resume summary:

Accomplished Medical Collector with 7+ years of experience working with multiple vendors to successfully resolve claims and collect payments. Recognized for exceptional communication and negotiation skills as well as the ability to develop positive relationships with clients/customers.

Collection agent resume summary:

Self-motivated Collection Agent with demonstrated ability to negotiate settlement payments or a payment arrangement that accommodates the borrower's finances. Highly recognized for handling currency and financial transactions accurately and resolving discrepancies in a timely manner. 3 years of working in ZAP Asset and maintaining a monthly quality control average of 97%.

What are essential collection skills for a resume

This is where you need to track down required skills in the debt collector job description. Hence, you can tailor your resume to the position’s needs and show employers what you actually possess to be the right fit.

List of collection skills for a resume:

| Hard skills | Soft skills |

| - Payment arrangements - Self-directed - Risk and asset management solutions - Bankruptcy - Policy and procedures | - Communications - Interpersonal skills - Attention to detail - Patient - Stress management |

📝 Tip: When writing debt collector skills for your resume, make sure to include both soft and hard (technical) skills with approximately 3-6 each, and keep them short and relevant.

How to write a collection agent resume with no experience

✨ Advice 1: Adopt the right collector resume format.

Three common types of resume formats are chronological, functional, and combination (hybrid).

For someone who is writing a debt collector resume with no experience, it’s recommended you adopt the functional format. This type of resume format groups your abilities under skills or categories of skill sets. This way, employers will focus more on your qualifications rather than the lack of work history.

✨ Advice 2: Write a coherent career objective.

In an entry-level debt collector resume, a strong career objective matters because you lack the experience needed to write a resume summary.

In a debt collector resume objective, state your career goals and enthusiasm for the target job. Be clear, realistic, and reflect your desire to contribute to the potential employer.

Example: “Leverage knowledge in Collections-Loss Mitigation and Mortgage Product to pursue a career in Les Mills.”

✨ Advice 3: Make the education section count.

Through this section, hiring managers can evaluate whether you meet the prerequisite for the position. A high school diploma is usually needed for this career, and relevant associate degrees include Sales, Finance, Marketing & Communications, etc.

When listing a degree on a resume, start with your school name, and list degree type, year of start & graduation. If you have taken relevant classes, feel free to add a short list of them.

✨ Advice 4: Beef up your resume with additional sections.

If you're writing a debt collector resume with no experience, extra information can make you stand out from other entry-level candidates, for instance:

- Languages

- Job-related certifications

- Personal projects/accomplishments

✨ Advice 5: Write a sincere collector cover letter.

Why is it crucial to submit a collector cover letter along with a resume?

- A cover letter can provide the information that you don’t have on your resume (e.g., the reason and motivation to apply for this job, details of a past experience).

- It’s often optional to submit a cover letter. Hence, you can outperform the competition compared to those sending a resume only.

You need to cover the following details in the cover letter for a debt collector job:

- Personal information and contact (full name, email, phone number, address)

- Self-introduction

- Motivation to apply for the job

- Qualifications

- Formal closing

📚 Reading The Cover Letter to Land Your Dream Job to get a better idea of how to write a cover letter with samples.

With CakeResume’s resume builder tool, resume templates and resume examples, you could showcase your best qualifications to land your dream job. Make your collector resume online (free download) now!

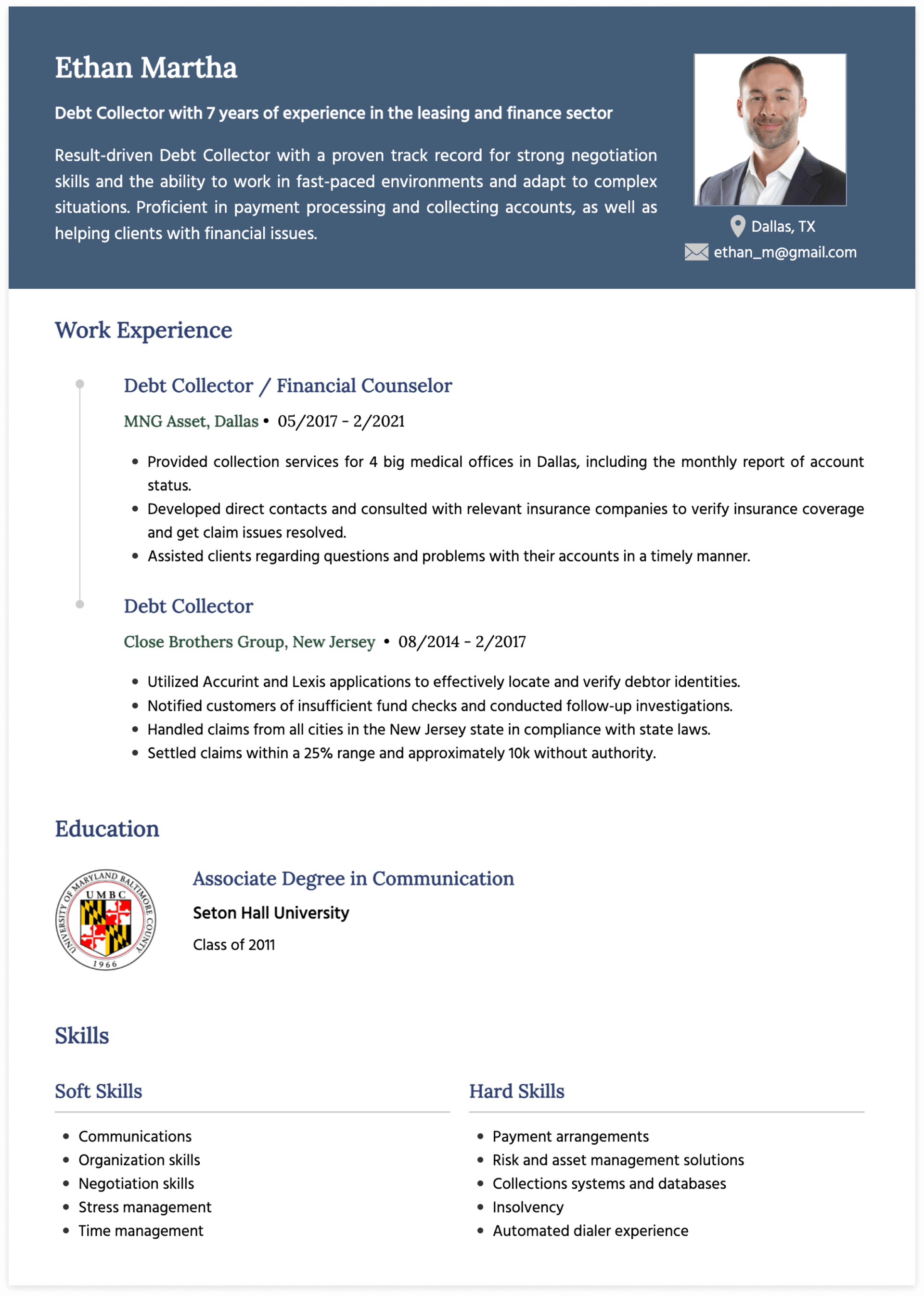

Collector resume sample

Ethan Martha

Debt Collector with 7 years of experience in the leasing and finance sector.

Result-driven Debt Collector with a proven track record for strong negotiation skills and the ability to work in fast-paced environments and adapt to complex situations. Proficient in payment processing and collecting accounts, as well as helping clients with financial management and payment plans.

ethan.[email protected]

Dallas, TX

Skills

| Hard skills | Soft skills |

| - Payment arrangements - Risk and asset management solutions - Collections systems and databases - Insolvency - Automated dialer experience | - Communications - Organization skills - Negotiation skills - Stress management - Time Management |

Work experience

Debt Collector/Financial Counselor

MNG Asset, Dallas

05/2017 - 2/2021

- Provided collection services for 4 big medical offices in Dallas, including the monthly report of account status.

- Developed direct contacts and consulted with relevant insurance companies to verify insurance coverage and get claim issues resolved.

- Assisted clients regarding questions and problems with their accounts in a timely manner.

Debt Collector

Close Brothers Group, New Jersey

08/2014 - 2/2017

- Utilized Accurint and Lexis applications to effectively locate and verify debtor identities.

- Notified customers of insufficient funds check and conducted follow-up investigations.

- Handled claims from all cities in the New Jersey state in compliance with state laws.

- Settled claims within a 25% range and approximately 10k without authority.

Education

Associate Degree in Communication

Seton Hall University

Class of 2011

--- Originally written by May Luong ---

More Career and Recruitment Resources

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!