Credit Analyst Resume Examples (Resume Objective, Summary, Skills)

You'll learn:

- How to write a great credit analyst resume?

- What is a good objective for a credit analyst resume?

- How to write a professional resume summary for a credit analyst job?

- What are some great skills to put on a resume for a credit analyst?

- How to write a credit analyst resume with no experience?

- Credit Analyst Resume Sample

Credit analysts, also known as credit risk analysts, generally work for insurance companies, credit rating agencies, commercial & investment banks, etc. Their primary role is to gather and analyze financial data to assess the creditworthiness of an individual or a company.

After evaluating financial information from the clients, credit analysts would determine the likely risk and recommend a course of action for them, including approving or denying a new credit account, interest rate, or extension of an existing credit line.

🔎 The difference between a credit analyst and a financial analyst:

A credit analyst exclusively analyzes debt (credit) opportunities, while a financial analyst prepares analysis on budgeting and forecasting to explain how to model debt and interest, investing, valuation, mergers, and acquisitions, etc.

For professionals looking to take the credit analyst career path or even those who are seeking career advancement opportunities, make sure your credit analyst resume fully captures what you can bring to the table.

Let's hop to it!

How to write a great credit analyst resume?

Tip 1: Optimize the credit analyst resume format for ATS.

More and more recruiters are using Applicant Tracking Systems (ATS) to automatically scan through all the applications before manually reading them. Creating an ATS-friendly credit analyst resume is a highly effective way to forward the resume to the potential employer and increase your interview chances.

👍 Key elements of an ATS-friendly credit risk analyst resume:

- Keyword optimization (see Tip 5)

- Simple and neat format for easy parsing

- Use standard headings

(Resume Summary, Skills, Work Experience, Education, etc.) - Stick to text

- Avoid tables, columns, heavy graphics, headers, and footers

Tip 2: Refer to great credit analyst resume templates and examples online.

Researching credit analyst resume examples online is vital to help you with the content and structure of a professional credit analyst resume regardless of all professional levels. You can also learn about some do's and don’ts while writing a credit risk analyst resume.

Tip 3: Tailor your credit analyst resume for the job opening.

Credit analyst jobs encompass a wide range of positions and each may focus on a particular area. Thus, feature your expertise and relevant skills based on the type of resume you're writing, for example, a commercial credit analyst resume, credit research analyst resume, or credit representative resume.

Besides, make sure you have a grasp on the differences between a credit analyst resume and a credit analyst CV, since resumes usually require more customization for the position.

Tip 4: Showcase quantifiable results on the credit analyst resume.

Accomplishments and awards you have achieved in the career can speak louder than a high GPA, especially when you bring figures and numbers to the table.

In your credit risk analyst resume or especially a senior credit analyst resume, you can quantify your achievements without much difficulty, for examples:

- How many credit lines of new and existing customers have you created and managed?

- How many percent of cost savings or loss reduction you've contributed to the company?

- How many colleagues have you trained, led, and supervised?

Example of quantifying results on a senior credit analyst resume:

Increased the average number of days to close from 8 to 2.5 by understanding vendor's procedures and successfully negotiating the payment process.

Tip 5: Insert relevant keywords from the credit analyst job description.

As mentioned earlier, keyword optimization is a key element of an ATS-friendly credit analyst resume. Not only the software can automatically compare your resume content to the job listing but the hiring manager can also better evaluate your qualifications.

Hence, make sure your credit analyst resume won't slip through the cracks due to the lack of relevant keywords.

Further reading: What Is the Difference Between CV and Resume?

What is a good objective for a credit analyst resume?

The hiring manager, impressed by your objective, will be motivated to read through your entire credit analyst.

Resume objective suggestions:

- Show them that you're career-oriented by including career goals

- Tailor it to the job opening

- Provide the exact name of the role and the company you’re applying for

- Keep it no longer than 2 sentences.

Credit analyst resume objective examples:

- Entry-level credit analyst resume: Looking to obtain a career as a Credit Risk Analyst to apply my solid background in the analysis of financial information.

- Credit representative resume: Seeking a Consumer Credit Representative position at Maaco to facilitate distribution of risk-related activity.

- Credit risk manager resume: To obtain the Credit/Risk Manager position where I can leverage my vast knowledge and experience in credit risk analysis including personal, banking, commercial credits, consumer products, etc.

📝 Check out amazing resume objective examples for 20+ different jobs at Career Objective for Resume|Samples, Formats, Writing Guide.

How to write a professional resume summary for a credit analyst job?

At the top of the credit analyst resume is a resume summary, ideally 3 sentences, that briefly showcases your professional skills and experience. This way the recruiter can get a quick picture of you before sailing into your credit analyst resume.

A well-written credit analyst resume summary should include the following information:

- Professional level and expertise in the field

- Outstanding achievements or awards

- Job-related skills and certifications

Examples of a credit analyst profile summary:

- Successful and experienced Risk & Credit Analyst with a robust portfolio of financial skills including, but not limited to Portfolio Management, Underwriting, and New Credit Origination. Team leader in designing and executing timely changes in procedures to respond to an $850k reduction in annual profit.

- Performance-driven and analytical Credit Analyst with 5 years of experience in business risk management within the real estate industry. Adept at establishing value-at-risk measurements, forecasting and monitoring market trends, underwriting with medium-sized business loans, etc.

- Passionate Credit Risk Controller who understands the need for commercial ventures with 10 years of market research positions and running figures through often complex modeling techniques. An expert in credit structuring, loan workouts, and relations management.

CakeResume provides the right templates & formats for credit analysts to showcase their skills and experiences. Sign up to create the best credit analyst resume and download it for free, Now!

What are some great skills to put on a resume for a credit analyst?

This is where you need to go through the credit analyst job description to list the skills section effectively. In addition to the skills you actually possess, make sure all of them are relevant to the position.

When listing skills for a credit analyst, keep the following in mind:

- Include both hard and soft skills with approximately 5 each.

- Stay truthful about your skills.

- Keep them short and relevant.

- Adopt the suitable format to list the skills section among 4 common formats (bullet lists, expanded bullet lists, integrated with work experience, and categorized skills section). Read about the pros and cons of each skills format to select the right one for your credit analyst resume.

Key skills for a credit analyst resume:

Hard Skills

- Credit reports

- Risk analysis

- Loan portfolio

- TurboTax

- Personal Capital

Soft Skills

- Analysis skills

- Attention to detail

- Time management

- Documentation and organization skills

- Problem-solving

✅ Tip: You can skip basic skills such as computing, Internet research, or Microsoft Office otherwise you may mingle with the crowds.

How to write a credit analyst resume with no experience?

✍🏻 Advice 1: Select the right credit analyst resume format.

Technically, your choice of resume format can affect how easily ATS scans and reviews your credit risk analyst resume. Thus, keep the formatting simple, neat, and well-structured.

In terms of content, the right adoption of resume format can determine how well you can demonstrate your capabilities in your credit analyst resume. As a fresh graduate or entry-level professional, you may consider using a functional or hybrid resume format to emphasize your credit analyst skills instead of work experience.

✍🏻 Advice 2: Craft an impressive career objective.

If you have no experience, skip the resume summary and craft a resume objective instead. A job-winning career objective for a credit analyst can show the recruiter whether the job aligns with your career path through a brief demonstration of skills and professional goals. Don't forget to include the value you could contribute to the employer.

✍🏻 Advice 3: Highlight your education.

Credit analysts are commonly required to have a business-related degree, such as finance, accounting, or economics. Hence, fill it out accurately and include relevant details such as courses and GPA, especially if you haven't gained much work experience.

Note: If you have multiple advanced degrees, rank them with the highest first.

✍🏻 Advice 4: Include relevant certifications.

Light up your entry-level credit analyst resume by bringing up any credit analyst certification that you’ve obtained. That's how you prove yourself as a capable and competent professional to the hiring manager.

Top Credit Management Certifications:

- Certified Credit and Risk Analyst from NACM

- Credit Risk Certification from RMA

- Certified Credit Professional from CIC

- Commercial Banking and Credit Analyst from CFI

✍🏻 Advice 5: Write a professional credit analyst cover letter.

Even when you're not required to submit a credit risk analyst cover letter, outperform the competition by crafting a sincere one.

The cover letter for a credit analyst with no experience should include the following information:

- Brief self-introduction

- Educational background

- Credit analyst certifications or side projects

- Key credit analyst skills

- Personal traits that benefit you at work

- Motivation to apply for the job opening

Credit Analyst Resume Sample

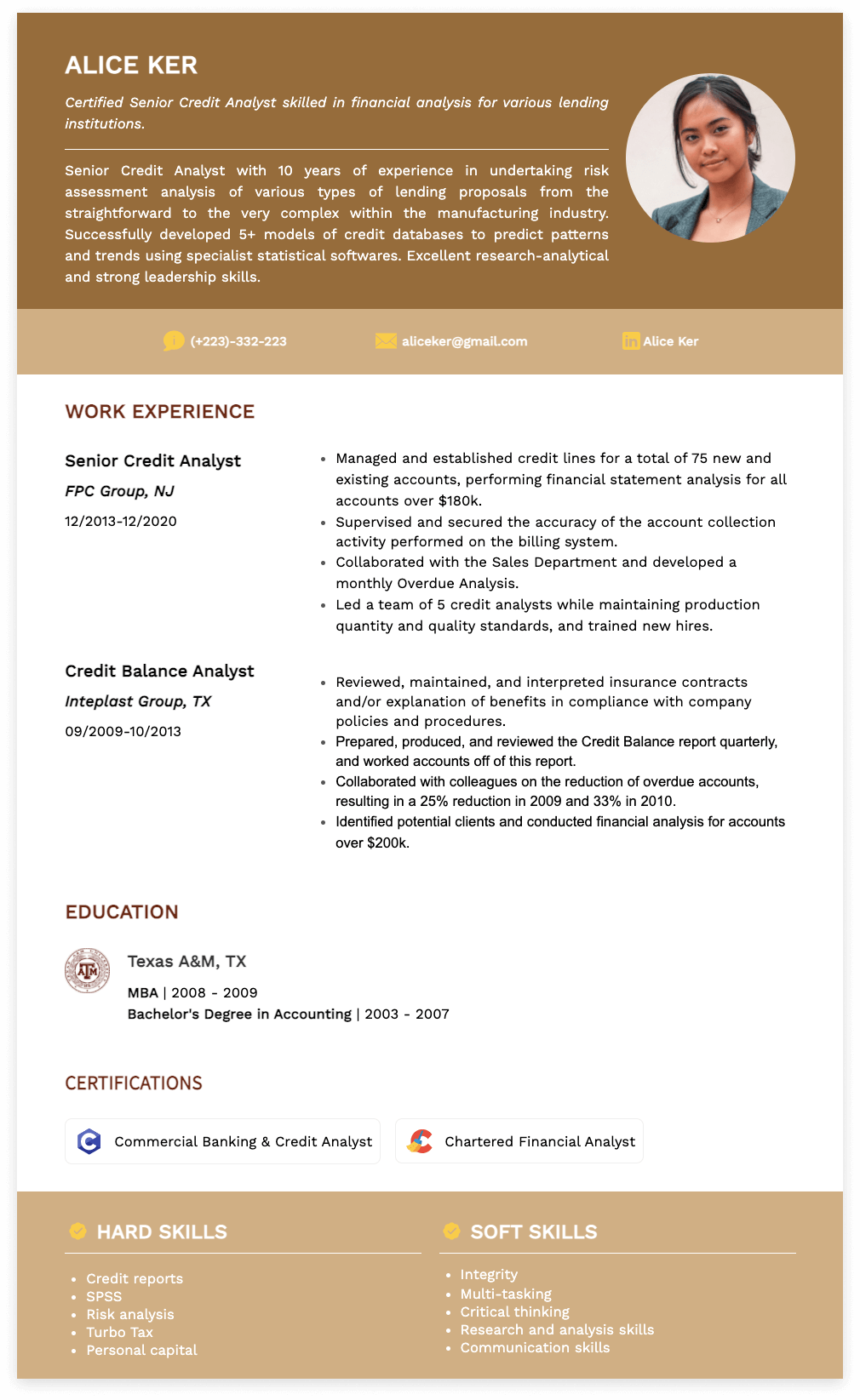

Alice Ker

Certified Senior Credit Analyst skilled in financial analysis for various lending institutions

[email protected]

(+233)-332-223

LinkedIn.com/in/aliceker

Professional Summary

Senior Credit Analyst with 10 years of experience in undertaking risk assessment analysis of various types of lending proposals from the straightforward to the very complex within the manufacturing industry. Successfully developed 5+ models of credit databases to predict patterns and trends using specialist statistical softwares. Excellent research-analytical and strong leadership skills.

Work Experience

Senior Credit Analyst

FPC Group, NJ

12/2013- 12/2020

- Managed and established credit lines for a total of 75 new and existing accounts, performing financial statement analysis for all accounts over $180k.

- Supervised and secured the accuracy of the account collection activity performed on the billing system.

- Collaborated with the Sales Department and developed a monthly Overdue Analysis.

- Led a team of 5 credit analysts while maintaining production quantity and quality standards, and trained new hires.

Credit Balance Analyst

Inteplast Group, TX

09/2009 - 10/2013

- Reviewed, maintained, and interpreted insurance contracts and/or explanation of benefits in compliance with company policies and procedures.

- Prepared, produced, and reviewed the Credit Balance report quarterly, and worked accounts off of this report.

- Identified potential clients and conducted financial analysis for accounts over $200k.

- Collaborated with colleagues on the reduction of overdue accounts, resulting in a 25% reduction in 2009 and 33% in 2010.

Education

MBA | Texas A&M

2008 - 2009

Bachelor's Degree in Accounting | Texas A&M

2003 - 2007

Skills

Hard Skills:

- Credit reports

- Risk analysis

- SPSS

- TurboTax

- Personal Capital

Soft Skills:

- Integrity

- Multi-tasking

- Critical thinking

- Research and analysis skills

- Communication skills

Certifications

- Commercial Banking & Credit Analyst

- Chartered Financial Analyst

--- Originally written by May Luong ---

Más recursos de carrera y contratación

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!