Tax Accountant Resume Examples & Guide

You'll learn:

The role of a tax accountant comes with significant responsibilities, including analyzing fiscal matters and preparing, submitting and managing tax statements and returns for businesses and clients.

With in-depth knowledge of regulations and acts, they are also responsible for providing advice on accounting, financial, and tax matters.

If you’re looking to obtain a tax account position, make sure you graduated with a relevant background, possess strong knowledge of tax law and regulations, as well as professional work experience.

Most importantly, demonstrate all these things on your tax account resume to impress the hiring manager and land the dream job.

Let's make it happen with our step-by-step guide and a killer tax accountant resume sample.

How to write a strong tax accountant resume in 5 easy steps?

Step 1: Grab the employer's attention with a strong resume headline.

Put it simply, a resume headline is like a resume title. In only one sentence, you need to introduce yourself to the hiring managers in the most impressive way. You can focus on your professional expertise, outstanding achievements, or anything that makes you stand out from other candidates.

Examples of a well-branded tax accountant resume headline:

- Entry-level tax accountant resume

“College Grad with broad knowledge of tax regulations as well as an understanding of state and foreign tax issues.”

- Junior tax accountant resume

“Tax Accountant with demonstrated ability to assist clients of different industry sectors with general taxation consultancy.”

- Senior tax accountant resume

“CPA Tax Accountant with 10 years of experience in the aspect of personal property tax administration.”

Step 2: Boost your tax accountant resume with an impressive summary.

A summary statement consists of 3-5 sentences and synthesizes the key highlights of your tax accountant resume, including:

- Years of experience

- Expertise/Core competencies

- Significant accomplishments in the career (especially for a senior tax accountant resume)

- Skills needed for the job

👍 Get it right as it can impress hiring managers better and motivate them to dive into your tax accountant resume.

Examples of a strong tax accountant resume summary:

- Entry-level tax accountant resume summary

Enthusiastic New York University Graduate major in Taxation with a solid understanding of payroll taxes, corporate tax law, and tax returns. Key skills include an eye for detail, staying calm under pressure, and the ability to work well on multiple tasks.

- Junior tax accountant resume summary

Licensed Public Accountant with 3+ years working in Deloitte LLP. Responsible for personal and business tax returns for federal, states, corporates, and individuals. Adept at conducting research and collecting data for various accounts.

- Senior tax accountant resume summary

Meticulous Certified Sr. Professional with 15 years of experience in reviewing complex returns from partnerships and corporates, and handling formal responses of state and federal tax notices. A strong team leader who trains and supervises a team of tax accountants who assist clients with their income tax statements.

Step 3: Feature important skills that employers value.

Everyone knows how to list skills on resumes. But, not many spend time and effort on polishing the skills section to help increase your opportunity of getting hired.

By closely examining the tax accountant job description, you can identify what skills the employers are looking for and provide them with key information to assess whether or not you obtain the skills needed.

Example of essential skills for a tax accountant:

| Hard skills |

| CCH and RIA Checkpoint Account analysis Revenue projections Account reconciliation Profit and loss |

| Soft skills |

| Analytical skills Time management Deal with tight deadlines Stay calm under pressure Critical thinking |

Further reading: Check out this comprehensive resume skills guide to learn how to format the skills section.

Step 4: List education on your tax accountant resume.

Tax accountant jobs usually require specialized training and at least a bachelor's degree in one of the following fields:

- Accounting

- Finance

- Economics

- Business Administration

❗ So it's a must that you list your educational background on your tax accountant resume

Example:

M.S. in Accountancy

University of Southern California

Class of 2014

B.A. in Accounting and Science in Taxation

University of North Carolina

Class of 2007

📝 Note that if you're writing a tax accountant resume with no experience, put the education section ahead of your work experience.

Step 5: Tailor the tax accountant resume to the specific job.

Think of this step as the synchronization of skills and responsibilities from a specific job listing to your resume content. The goal is to state that you would fit the position well, instead of tax accountant jobs in general.

To do so, go line-by-line through the tax accountant job description and ask yourself these questions:

- How effectively can you relate these skills from the job description to those on your tax accountant resume?

- Are you using the same words and terms found in the job description?

- Does your tax accountant resume state that you can do this job?

What format do most employers prefer for a tax account resume?

Which tax accountant resume format you select will depend on your professional level. Let us walk you through it!

Chronological resume format

A chronological resume is a resume format that lists your jobs in reverse chronological order, from the most recent job to the very first one. This format is the most popular as recruiters find it easy to read and follow.

➡️ You may adopt this - if you have gained a consistent work history and increased job levels over time.

Functional resume format

Functional resumes focus on skill sets relevant to the job opening. The purpose is to turn the attention to transferable capabilities rather than work experience.

➡️ You may adopt this - if you are fresh graduates, entry-level individuals, or career changers.

Combination resume format

A combination resume is a merge of the previous two resume formats, in which you begin with the skills sections, and then demonstrate your former jobs and achievements.

➡️ You may adopt this - if you re-entering the workforce or have limited work experience in the field.

Professional resume template for tax accountant jobs

Before writing your resume, check out several online tax accountant resume examples first to get some idea about how to properly present information.

Next, you can use Microsoft Word, the most widely-used word processing and document creation. From many resume templates available on the online library, you can select one and simply fill in the text.

But why create your tax accountant resume from scratch while you can easily do it with online resume builders, like CakeResume? All you need to do is choose a refined template, customize the text and/or layout in 5 minutes, save the file as PDF, and conquer the competition.

CakeResume provides the best tax accounting resume templates & examples for talents to demonstrate their qualifications. Let us help you land the dream as a tax accountant with a strong resume (free download)!

Top 10 tax accountant resume dos and don’ts

✅ Dos:

✏️ Highlight your certifications or licenses

For candidates qualified for tax accountant positions, your resume should highlight the completion of special training or programs in the resume summary or an individual section, such as:

- Certification Public Accountant (CPA)

- Institute of Public Accountants (IPA)

- Certified Tax Planner (CTP)

✏️ Underline the numbers

In the resume summary and work experience, hiring managers expect to see something practical, compelling, and convincing. Especially in the tax & accounting field, you should be able to bring a lot of numbers and data to the table.

For instance: “Reviewed the filing of tax returns for up to 35 CSC entities monthly.”

✏️Make sure your tax accountant resume is ATS-compliant

ATS stands for Applicant Tracking System, a software used for collecting and scanning eligible job applications. The tricks to beat the bot are inserting keywords from the job description and avoiding graphs.

✏️ Keep the formatting of your tax accountant resume consistent

Regarding the best way to present content on your resume, it's important to ensure the consistency of such elements as color, font, size, etc.

That's why online resume builders like CakeResume are now taking over traditional tools like Word as you no longer have to worry about setting line spacing or margin.

✏️ Use powerful action verbs

Besides keywords from the job ad, action verbs can give your tax accountant resume a boost - clarifying your contributions and setting a confident tone. They can better demonstrate your work experience and accomplishments. For example, start your bullet points with “resolve”, “review”, “manage”, or “increase/reduce”.

⛔️ Don’ts:

📌 Mistake a tax accountant resume with a tax accountant CV

A resume focuses on work experience and skills related to the job only, while a CV mentions all the candidate’s details, including professional and academic achievements.

📌 Draft an old-style resume objective statement

An objective statement can make or break your resume - see the examples below for a clearer idea:

❌ “Looking to become a tax accountant at ABC company."

This statement is too generic and the employer can't see either career goals or enthusiasm for the job. Try to write something like the following instead:

⭕ “Eager to join the Tax Account team so I can apply my knowledge in financial planning and tax strategies to minimize the financial risks of ABC company.”

📌 Disclose confidential information about previous employers

Confidentiality plays a vital role in the tax accounting field, which is also mentioned in the Code of Ethics for Professional Accountants.

So, be cautious while writing your tax accountant resume otherwise you can get into trouble regarding legal issues and lose your credibility.

📌 Provide unnecessary personal details

In most parts of the world, discrimination is against the law, especially the modern hiring process. With that said, you should avoid including personal details that might lead to biases, such as gender, marital status, political affiliation, religion, etc.

📌 Submit your tax accountant resume as a Word doc

A Word document is the easiest file type to edit, giving it a huge advantage - but it's absolutely not the safest bet! Employers may encounter many formatting issues if they open the file with different devices. Learn more at What Is the Difference Between CV and Resume?

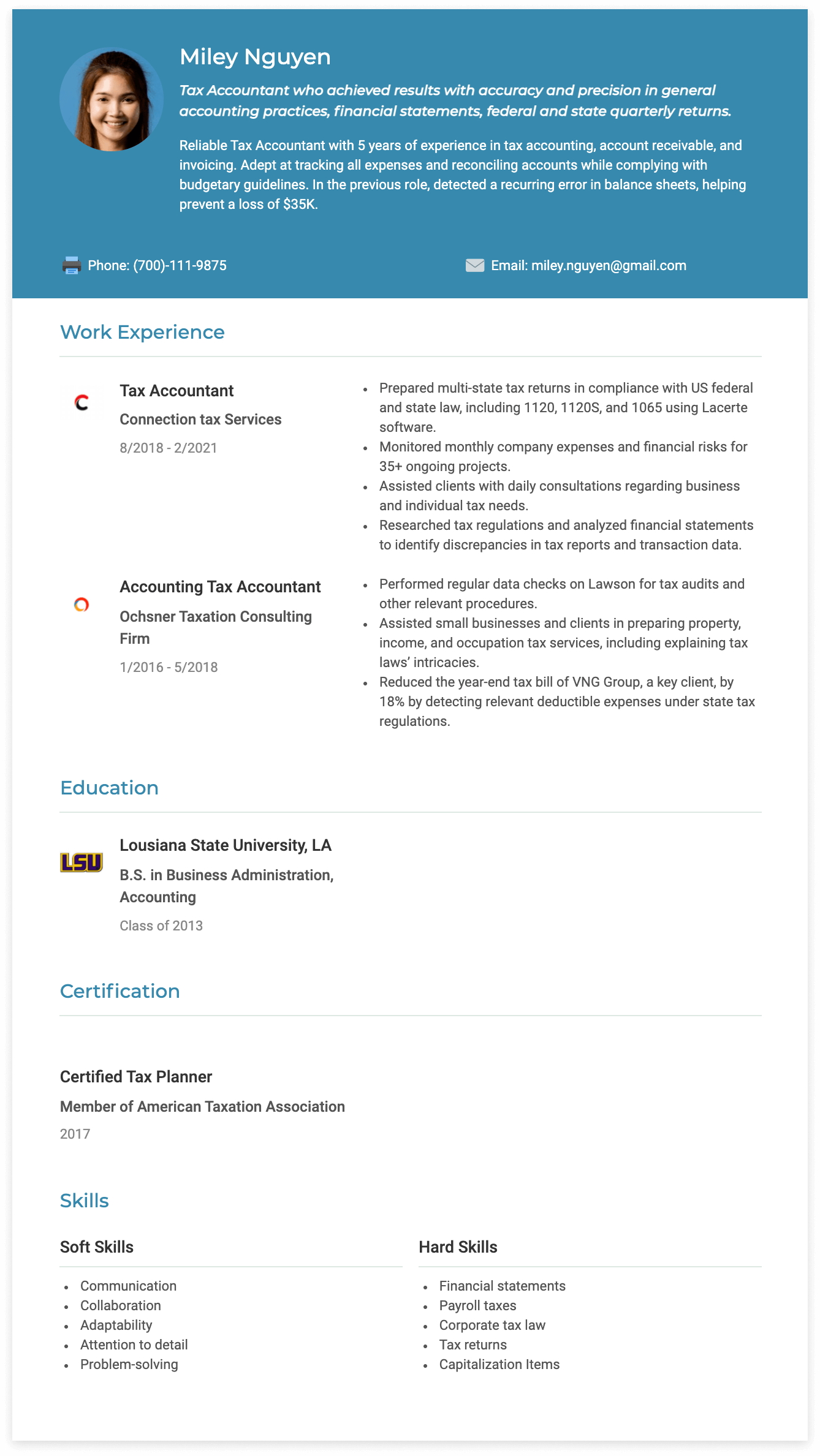

Tax accountant resume sample

Miley Nguyen

Tax Accountant who achieved results with accuracy and precision in general accounting practices, financial statements, federal and state quarterly returns.

Phone: (700)-111-9875

Email: [email protected]

Profile

Reliable Tax Accountant with 5 years of experience in tax accounting, account receivable, and invoicing. Adept at tracking all expenses and reconciling accounts while complying with budgetary guidelines. In the previous role, detected a recurring error in balance sheets, helping prevent a loss of $35K.

Work Experience

Tax Accountant, Connection Tax Services

8/2018 - 2/2021

- Prepared multi-state tax returns in compliance with US federal and state law, including 1120, 1120S, and 1065 using Lacerte software.

- Monitored monthly company expenses and financial risks for 35+ ongoing projects.

- Assisted clients with daily consultations regarding business and individual tax needs.

- Researched tax regulations and analyzed financial statements to identify discrepancies in tax reports and transaction data.

Accounting Tax Accountant, Ochsner Taxation Consulting Firm

1/2016 - 5/2018

- Performed regular data checks on Lawson for tax audits and other relevant procedures.

- Assisted small businesses and clients in preparing property, income, and occupation tax services, including explaining tax laws’ intricacies.

- Reduced the year-end tax bill of VNG Group, a key client, by 18% by detecting relevant deductible expenses under state tax regulations.

Skills

| Soft skills |

| Communication Collaboration Adaptability Attention to detail Problem-solving |

| Hard skills |

| Financial statements Payroll taxes Corporate tax law Tax returns Capitalization Items |

Education

B.S. in Business Administration, Accounting

Louisiana State University, LA

Class of 2013

Certifications

Certified Tax Planner (2017)

Member of American Taxation Association

--- Originally written by May Luong ---

Más recursos de carrera y contratación

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!