Professional Tax Preparer Resume Examples [+ Skills, Objective, Summary]

You'll learn:

Tax season is the time of the year that most people dread. The complexity of preparing one’s taxes is high, which is why some may opt to employ the help of a tax preparer. Tax preparers, as its name suggests, calculates, prepares, and files taxes on behalf of everyday people or even businesses. Tax preparers will have to review their clients’ income statements, expenses, and other relevant documents to determine which circumstances may lead to tax credits or deductions.

To ensure that you instill confidence in recruiters and potential clients, you would want to make your tax preparer resume as professional as possible to increase your chances of getting hired. Understanding the essence of what makes a great tax preparer CV can make your resume-making journey seamless.

How to write a great tax preparer resume?

Tip 1: Adopt an ATS-friendly resume format.

Technology has changed how recruiters sift through candidates. Nowadays, most recruiters would use an ATS (applicant tracking software) to filter through the tax preparer CVs they receive to make the recruitment process easier for them. An ATS will scan and rank all the tax preparer resumes they receive, which would help decrease the number of resumes that recruiters will have to read through.

💡If you want to get through this first hurdle, make sure that you adopt ATS-friendly resume formats (e.g., tax preparer resume templates, little to no visuals, implement keywords from the job ad into your resume).

Tip 2: Refer to online tax preparer resume templates and tax preparer resume examples.

Online, you will be able to find a plethora of tax preparer resume templates and tax preparer resume examples that you can refer to when crafting your own. Be aware that these online tax preparer resume examples and templates may not necessarily fit all of your needs and backgrounds.

So, do adjust them accordingly depending on the job context and your qualifications.

Tip 3: Tailor your tax preparer CV for the job position and adopt keywords

In general, resumes are used for job applications and would usually require tailoring. CVs, on the other hand, are mainly used in science fields, academia, or medicine and won't need as much tailoring. These differences don't affect the job description of a tax preparer though, so the terms “tax preparer resume” and “tax preparer CV” can be considered as synonyms of each other.

Note: “Resumes” and “CV” can be used interchangeably.

That being said, no matter what you decide to call it, you should still tailor your tax preparer CV to fit the job position and make your candidacy more relevant to recruiters. Sections that you should mainly tailor may include your tax preparer resume skills, your tax preparer resume objective and/or summary, and your tax preparer resume description.

Tip 4: Quantify results on your tax preparer resume.

If you’ve had any tax preparing-related achievements or results, you will definitely want to show them off. Describe them quantitatively instead of qualitatively to increase the impact of your tax preparer resume. Doing so will make your CV look more convincing and more apparent.

Tip 5: Create a new section for your license or certifications.

If you’ve done the hard work of obtaining a license or any tax preparation-related certifications, for any sort of tax preparer resume (especially for a certified tax preparer resume), it’s best to create a new section to fully highlight them in your tax preparer CV.

What is a good tax preparer resume objective?

Including a tax preparer resume objective in your CV might sound old-fashioned, but it can help recruiters understand your career goals and aspirations. A resume objective is usually short (single-lined) and should be at the top of your resume.

💡 Your tax preparer resume objective should highlight your qualifications, what you wish to achieve (career-wise) and be worded concisely.

Tax preparer resume objective examples:

- Certified tax preparer, well-versed in state and federal tax regulations. Looking to leverage my income tax regulations and account analysis knowledge in ABC Corp.

- Motivated accounting graduate seeking an opportunity to improve and display my mathematical skills and strong work ethic in a professional setting.

- Knowledgeable tax preparer with 9+ years of experience preparing taxes for high net-worth individuals and businesses. Seeking to leverage my extensive knowledge of foreign tax regulations and tax reduction and compliance expertise in XYZ Corp.

How to write a professional tax preparer resume summary?

Your tax preparer resume summary should be able to summarize the contents of your tax preparer resume within a sentence or two. Remember, recruiters can’t afford to spend a lot of time on one resume, so including a resume summary can help them to quickly get an idea of who you are as a candidate.

💡 A good tax preparer resume summary should contain the main essence of your CV. You will want to include your tax preparing-related background, skills, qualifications, and achievements. Do remember to also keep your resume summary well-structured and concise.

Tax preparer resume summary examples:

- Client-focused tax preparer specializing in income tax deductions and compliance. Demonstrated 100% accuracy when producing tax reports at ABC Tax Services.

- Knowledgeable and experienced tax preparer with more than 10 years of experience. Well-versed in federal and state tax regulations and administered an average of 140 tax reports per tax season.

- Eager and motivated accounting graduate. Proven ability to be meticulous and hardworking, seeking to leverage my familiarity with GAAP and tax knowledge for the tax preparer position in XYZ Tax Services.

What are some great tax preparer skills for a resume?

Tax preparation skills are one of the elements that will define how recruiters will see your candidacy. No matter the type of resume you have, whether an entry-level tax preparer resume or even a certified tax preparer resume, skills are one of the most important aspects of your CV. Although the skills that you possess are important, structuring them in a professional manner is just as important.

There are four formats to choose from for your tax preparer resume skills:

📝 Simple bullet list:

Easy to craft because of its simple structure. Desired skills are also easily seen by recruiters. However, its simplicity means you can’t elaborate on your skills.

📝 Expanded bullet list:

A more detailed version of the simple bullet list, allowing you to explain how you’ve applied your tax preparer resume skills. The room for elaboration means that it will be lengthier than the simple bullet list, thus, the skills you can include should not exceed five.

📝 Integrated with work experience:

A format that allows you to complement your experience section with your skills section by integrating them. Because of this, this format is better suited for a senior tax preparer resume with more experience. Entry-level tax preparer resumes or a tax preparer resume with no experience may not be able to use this format due to their inexperience.

📝 Categorized skills section:

Help you organize your tax preparer resume skills by segregating your possessed skills into specific categories. Just like the integrated with work experience, inexperienced tax preparers may not benefit much if they were to implement this format on their tax preparer CV.

The best tax preparer resume skills format for you will depend greatly on your skill level as well as the job context. So, ensure that you’ve made a comprehensive evaluation of your background before you fully commit to a format.

Tax preparer resume skills examples:

Hard skills:

- Tax compliance

- Tax returns

- Foreign tax regulations

- Income tax regulations

- Financial analysis

- Payroll taxes

Soft skills:

- Attention to detail

- Time management

- Problem-solving

- Critical thinking

- Decision-making skills

CakeResume provides the best tax preparer resume templates & examples for talents to demonstrate their qualifications. Let us help you land the dream as a tax preparer with a strong resume (free download)!

How to write a tax preparer resume with no experience?

✅ Advice 1: Choose the right resume format for a tax preparer resume with no experience

For a tax preparer resume with no experience, there are four formats that you can use: chronological, functional, hybrid/combination, and targeted.

The formats will benefit certain candidates differently, so evaluate your overall qualifications, background, before deciding on a format to implement on your tax preparer CV.

✅ Advice 2: Adopt a tax preparer resume objective

Worrying about your lack of experience in an entry-level tax preparer resume is understandable. You can ease off some of your worries by adopting a tax preparer resume objective to redirect the recruiter’s attention away from your lack of experience and to your career aspirations and goals.

✅ Advice 3: Highlight your education

Your educational qualifications are especially important if you have an entry-level tax preparer resume. Your education is formal and definitive proof of your knowledge and skills on tax laws and tax preparations.

✅ Advice 4: Include your portfolio/side project/personal website

If you’ve had any side projects, portfolios, or personal website that highlights your skills as a tax preparer or are in line with the job context, including it in your entry-level tax preparer resume can help boost your standing with recruiters; as they give you a chance to highlight your qualifications.

✅ Advice 5: Write a sincere personal banker cover letter

A tax preparer cover letter is a single-paged document where you can further explain your qualifications and tax preparer background. With a maximum of two pages only, your tax preparer CV won’t have enough space for you to elaborate on certain things and to fully convey your passion and potential as a candidate.

To write a great tax preparer cover letter, open with an introduction of yourself and include your contact details. Your cover letter should also contain some elaboration on your relevant experience, achievements, skills, and education. Remember to explain why the position is perfect for you and your motivations for applying. Finally, close off politely, thanking the recruiters for taking the time to read through your tax preparer cover letter.

Tax preparer resume sample

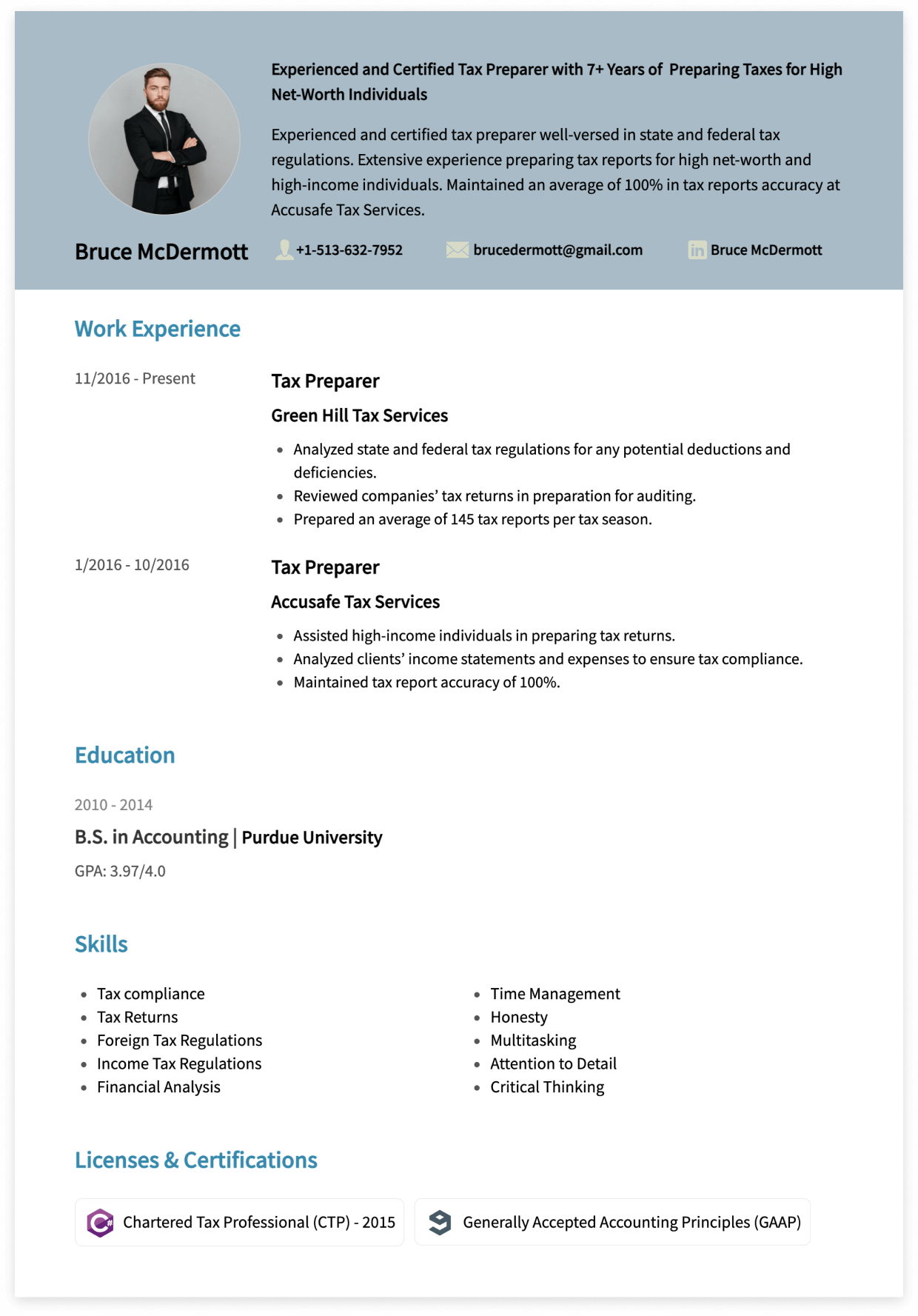

Bruce McDermott

Experienced and Certified Tax Preparer with 7+ Years of Experience Preparing Taxes for High Net-Worth Individuals

+1- 513-632-7952

[email protected]

linkedin.com/in/brucemcdermott

Professional Summary

Experienced and certified tax preparer well-versed in state and federal tax regulations. Extensive experience preparing tax reports for high net-worth and high-income individuals. Maintained an average of 100% in tax reports accuracy at Accusafe Tax Services.

Work Experience

Tax Preparer

Green Hill Tax Services

Nov. 2016 – Present

- Analyzed state and federal tax regulations for any potential deductions and deficiencies.

- Reviewed companies’ tax returns in preparation for auditing.

- Prepared an average of 145 tax reports per tax season.

Tax Preparer

Accusafe Tax Services

Jan. 2014 – Oct. 2016

- Assisted high-income individuals in preparing tax returns.

- Analyzed clients’ income statements and expenses to ensure tax compliance.

- Maintained tax report accuracy of 100%.

Education

2010– 2014, BSBA in Accounting

Purdue University

GPA: 3.97/4.0

Skills

- Tax compliance

- Tax Returns

- Foreign Tax Regulations

- Income Tax Regulations

- Financial Analysis

- Time Management

- Honesty

- Multitasking

- Attention to Detail

- Critical Thinking

Certifications & License

Chartered Tax Professional (CTP), 2015

Generally Accepted Accounting Principles (GAAP) Certificate

--- Originally written by Patricia Rosita ---

D'avantage d'Infos sur les Carrières et le Recrutement

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!