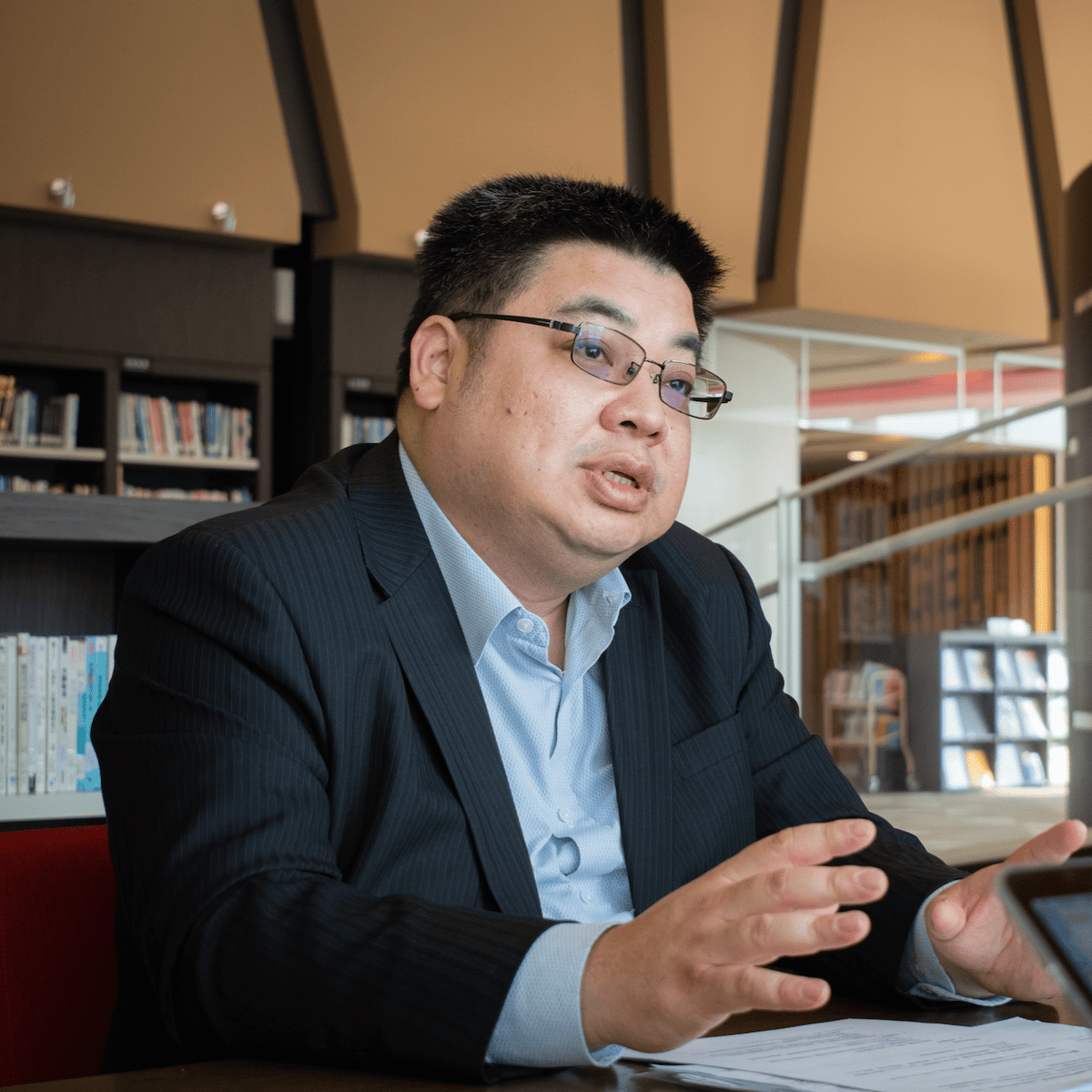

Friedman Wang

Experienced Credit Cycle Head with a demonstrated history of working in the banking industry. Strong finance professional skilled in Banking, Credit Analysis, Credit Cards, Credit Risk, Loans, and Big Data & AI.

Work Experience

Executive VP, Head of Big Data R&D

CTBC Financial Holding Co., Ltd • Jan 2018 - Present

Executive VP, Head of Group Retail Credit

CTBC Financial Holding Co., Ltd • Oct 2006 - Present

Head of Unsecured Credit

China Trust FHC • Oct 2006 - Present

- Head and manage the unsecured portfolio with USD 7 bn outstanding balances, which is the leading brand in Taiwan. (HQs)

- Oversee and manage the unsecured portfolio in Phillippine and Indonesia with USD 170 mn outstanding balances.

Value Center Risk Manager of Credit Cards and Personal Loan

Standard Chartered Bank • May 2005 - Oct 2006

- Credit Policy & Strategy

- Revamped Taiwan’s credit policy and portfolio management strategy for Credit Cards and Personal Loan and leading the way among the Asia Pacific practice

- Developed and managed 4 credit scorecards during the last 15 months.

- Maintained and renewed product programs and support business to explorer the portfolio potentials under acceptable risk appetites

- Upgraded collection strategy and co-worked with South Africa’s consulting firm to re-engineer the collection end-to-end process

- New Product Design & Support

- Support Business to evaluate the market conditions and how to re-enter the market to recover the growing momentum

- Revitalize Cards Business to develop 6 new products post the credit crisis, which includes Sales finance, home renovation loan, Junior SME loan, trade finance, debit cards, and SME cards. Five of them will be rolled out in 2H’06.

- Credit Crisis Management

- Instituted Interbank debt relief program (IDRP) and process building to streamline the debt restructuring mechanism among the industry

- Enhanced workout initiatives to mitigate the credit loss risks, which includes DRP and Settlement Strategy

- Business Utility Management

- Country Basel 2 coordinators and will complete the project before Sep’06

- JCIC country expert to deal with reporting projects

Education

National Taiwan University

Master of Business Administration (MBA)

1995 - 1997

Press

《經濟日報》中信銀秀肌肉 行銀業務稱霸國內

國內銀行業拚數位化轉型,中國信託銀行大秀肌肉,其行動銀行用戶,不含網路銀行部分,光是手機與平板,已飆破360萬人,短短一年大增60萬人,稱霸國內行動銀行市場。

《iThome》中國信託銀行瞄準新金融時代三大機會,將靠 AI、超級個人化以全通路迎戰純網銀

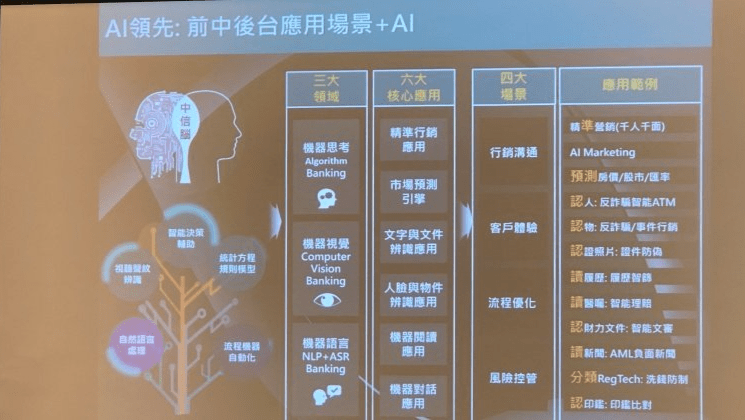

中國信託銀行數據暨科技研發處處長王俊權,近期揭露了自家觀察到新金融發展的3大機會。一是隨著經營環境改變,中信銀要搶攻數位金融這片新藍海,以AI確保金融大數據應用落地。二是以數據掌握顧客人生不同階段需求,提供超級個人化服務。三則是以Digital First結合全通路體驗,作為與純網銀競爭關鍵。