The Benefits of Rolling Over While Still Employed

The Benefits of Rolling Over While Still Employed

401(k) Benefits: The Advantages of Rolling Over While Still Employed

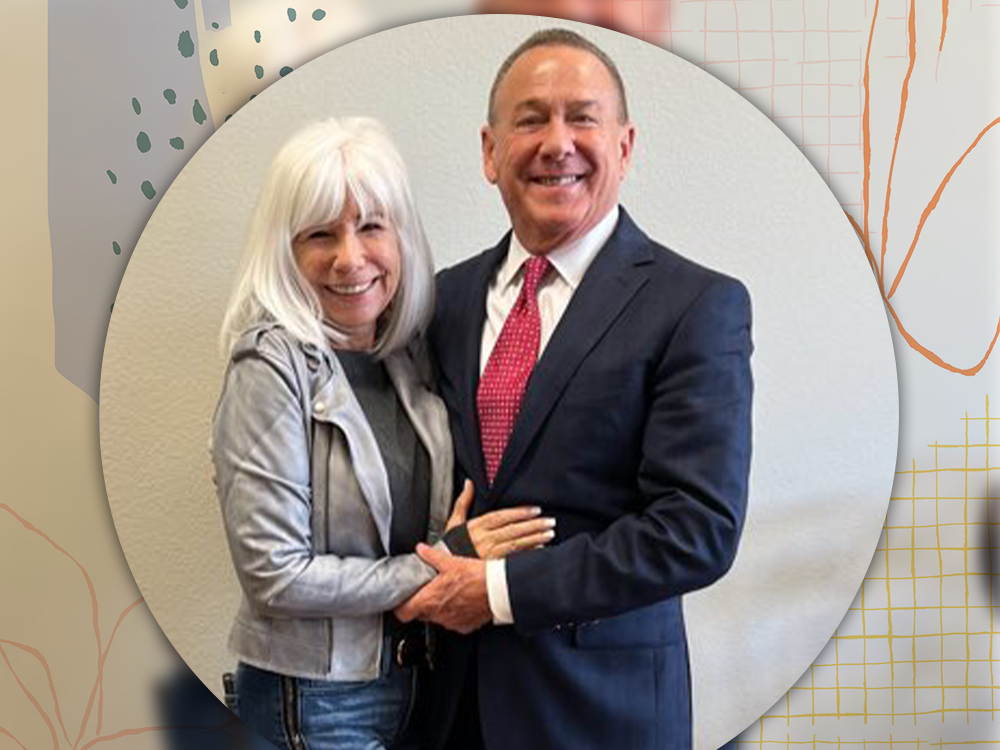

According to Skip West, 401(k) plans are a popular way for employees in the United States to save for retirement. However, only some people stay with the same employer their entire career, and it's common to change jobs and transfer your 401(k) to a new employer's plan. In such cases, you may wonder whether you should roll over your 401(k) while still working.

There are several advantages to rolling over your 401(k) while still working rather than waiting until you retire or change jobs.

Converting your 401(k) to an individual retirement account (IRA) gives you greater control over your investments. IRAs typically provide a broader range of investment options than 401(k) plans, allowing you to tailor your portfolio to your investment goals and risk tolerance. This allows you to maximize your returns and achieve your retirement goals faster.

Second, converting your 401(k) to an IRA can give you greater flexibility in managing your funds. For example, if you need money for an unexpected expense, you can borrow from an IRA without paying the early withdrawal penalty that you would with a 401(k) (k).

Converting your 401(k) to an IRA can help you simplify your financial situation. By combining your retirement savings into a single account, you can more easily track your progress and make necessary adjustments.

Finally, while you're still employed, rolling your 401(k) to an IRA can be a wise tax-planning strategy. Depending on your income and tax bracket, deferring taxes on your 401(k) until you retire and are in a lower tax bracket may make sense.

Finally, rolling over your 401(k) while still employed can provide several advantages, including increased control over your investments, greater flexibility in managing your funds, a simplified financial picture, and potential tax benefits. Before deciding, you should consider your financial situation and consult a financial advisor. You can ensure that your retirement savings are working as hard for you as possible by taking the time to understand the benefits and drawbacks of rolling over your 401(k).