Loan Officer Resume Examples, Formats, Templates [+Tips]

You'll learn:

Loans have become an indispensable part of our business life, especially when you need to generate a large amount of money. You may need help from a loan officer when proceeding to obtain a loan.

In general, loan officers work for commercial banks, mortgage companies, or credit unions. They apply their market knowledge and financial skills to test the borrower's creditworthiness to determine if they are qualified for a loan. Also, they may provide borrowers with advice on different borrowing situations or paperwork for granting the loan.

🔎 Fact: The role of a loan officer may bear some similarities to a loan processor’s scope of work. However, a loan processor is commonly in charge of the borrowers’ documents for submission to the underwriters while a loan officer mostly deals with the process of evaluating borrowers’ eligibility for a loan.

Regarding such responsibilities of a loan officer, a loan officer resume has to fully present the applicant’s knowledge in business and finance along with relevant skills such as time management, thoroughness, confidentiality, and analyzing information.

Check out this comprehensive guide on writing a professional loan officer resume with great loan officer resume examples!

How to write a professional loan officer resume?

Step 1: Draft a well-phrased resume headline.

A resume headline is a title that grabs the content of your entire loan officer resume and your professional level. Keeping it concise and unique within a sentence is the key to seize attention.

A recommended commercial loan officer resume headline consists of your current role, your strength preferably accompanied by a quantifiable number. Such elements will help you demonstrate your level and outstanding skills to strike an impression on the recruiter.

Examples of a well-structured headline of a credit officer resume:

- Loan Officer with 5 years of experience in bank loan and credits

- State-licensed Loan Officer specializing in loan supervisor

- Credit Officer with a focus on providing loan consultancy

Step 2: Write an attractive credit officer resume summary statement.

The profile summary of a credit officer resume is a section where you present shortly your personality, job experience, and achievements in 2-3 sentences. By highlighting your best features, you have a better starting point in the job-hunting game.

Examples of an eye-catching summary of a loan officer resume:

- Reward-motivated Loan Officer with a state-licensed certification in loan management. Possess a solid background and knowledge in finance, the ability to work well within fast-paced environments, and exceptional analytical skills.

- Certified Credit Loan Officer with 5 years of experience in providing loan planning and consulting. Adept at generating leads in commission-only banks and developing customers’ data sources for further sale-boosting projects.

- Credit loan officer with a commercial lending certificate. Specialize in maximizing conversion rates for closing loan cases, while maintaining a close relationship with financial agencies, private banks, and potential loan-seekers.

Step 3: Insert key skills of a loan officer.

With a well-structured skills section in the loan officer resume, you can demonstrate your strengths and showcase your ability. By grasping your skills, employers can decide whether you are the best fit for the vacancy.

👍 Reminder: The desired skill list should consist of both soft and hard skills.

For a consumer loan officer resume, these are the most needed skills to list down:

Soft skills

- Time management

- Decision making

- Customer service

- Attention to detail

- Communication skills

Hard skills

- Analytical skills

- Financial-software knowledge

- Spreadsheet

- Financial planning

- Organizational skills

Step 4: Tailor the loan officer resume to the specific job.

To make your loan officer resume more relevant to the position you're applying for, it’s important to adopt keywords from the loan officer job description resume. Only listing aspects concerning the specific position will increase your chance of getting an interview.

Step 5: Double-check.

Proofread is the last step to ensure your loan officer resume is well-written and flawless. In the specific field of finance and business, attention to details appears more important and vital than ever.

CakeResume provides the right resume templates & formats for loan officers to showcase their skills and experiences. Sign up to create the best loan officer resume and download it for free, Now!

What is the best resume format for a loan officer?

Most of the time, deciding the type of resume format to use is determined by the applicant’s specific purposes. For freshers who are drafting an entry-level loan officer resume, it seems to be more difficult to pick a suitable format.

No need to panic! Let us walk you through this.

There are four commonly-used types of resume formats:

✍🏻 Chronological resume format:

Your loan officer resume is presented in a reverse-chronological order with the latest experience and achievements listed first. The format best fits someone with intensive work experience. It is also the default format that most people can easily read and understand.

✍🏻 Functional resume format:

It’s a skill-based type of format that highlights your skills and personal traits that may benefit you at work. Specifically, if you are a fresh graduate or drafting a loan officer assistant resume, this format can help you demonstrate your strengths instead of showcasing employment history.

✍🏻 Hybrid resume format:

This type of format is a combination of the chronological and functional format. Not only does it list down relevant skills but it also presents working history. You may consider this format while writing an experienced credit officer resume.

✍🏻 Targeted resume format:

A commercial loan officer resume with this format type will be greatly customized with keywords to tackle the requirements shown in the job description. Thus, it's beneficial for those who are applying for a highly competitive position.

How to make a loan officer resume template?

Creating a neat and well-organized loan officer resume template is an indispensable step for a job-winning resume. You can either design one by yourself or download a resume sample for credit officers online.

Check out two most common tools for creating a professional mortgage loan officer resume on your own:

📝 Microsoft Word

- Refer to loan officer resume examples online in terms of standard sections (Work Experience, Education, Skills, etc.).

- Optimize heading tags for an ATS-friendly resume and avoid tables and graphs.

- Present content with reader-friendly formatting of text and font.

📝 Online resume builder

- Modify your own resume based on built-in loan officer resume templates.

- Simply add, remove, or change the content to match the job description.- Secure an ATS-friendly format.

👍 Note: Remember to submit your file as a loan officer resume pdf to avoid any issues while opening a doc file.

Top 10 Loan Officer Resume Dos and Don'ts

✅ Dos:

- Tailor the resume and include only relevant information:

Customize your loan officer resume to increase the level of relevance. - Add quantifiable and measurable achievements:

- Quantifiable and measurable numbers give more credibility to your listed accomplishments.

- Optimize the resume for ATS:

ATS (Applicant Tracking System) is a scanning system adopted to sort out CVs and resumes. Therefore, make sure to include keywords from the loan officer job description for your resume to reach the employers. - Choose the right resume format:

The suitable credit officer resume format helps you present your strengths while minimizing your weaknesses. - Use active verbs in the resume:

Active verbs express a strong sense of confidence, hence make your mortgage loan officer resume stand out among others.

❌ Don’ts:

- Mix up a loan officer resume with a CV:

A resume is different from a CV in terms of the user's purpose. While a CV lists out a person's experience and achievements with comprehensive details, a resume is often within 1 or 2 pages describing only the content designed for specific job applications. - Adopt an old-style mortgage loan officer resume objective statement:

An on-point loan officer resume objective with personalized information and motivation appeals more to the eyes of the employers. - Disclose confidential information about previous employers:

With this unprofessional manner, you could sabotage your credibility. - Include unnecessary personal details that might lead to discrimination:

Omit any information that’s not required to avoid disadvantages it may bring. - Send the resume as a Word doc:

A loan officer resume pdf file is more recommended than a Word doc one since it helps avoid font or template errors.

Loan Officer Resume Sample (Text Format)

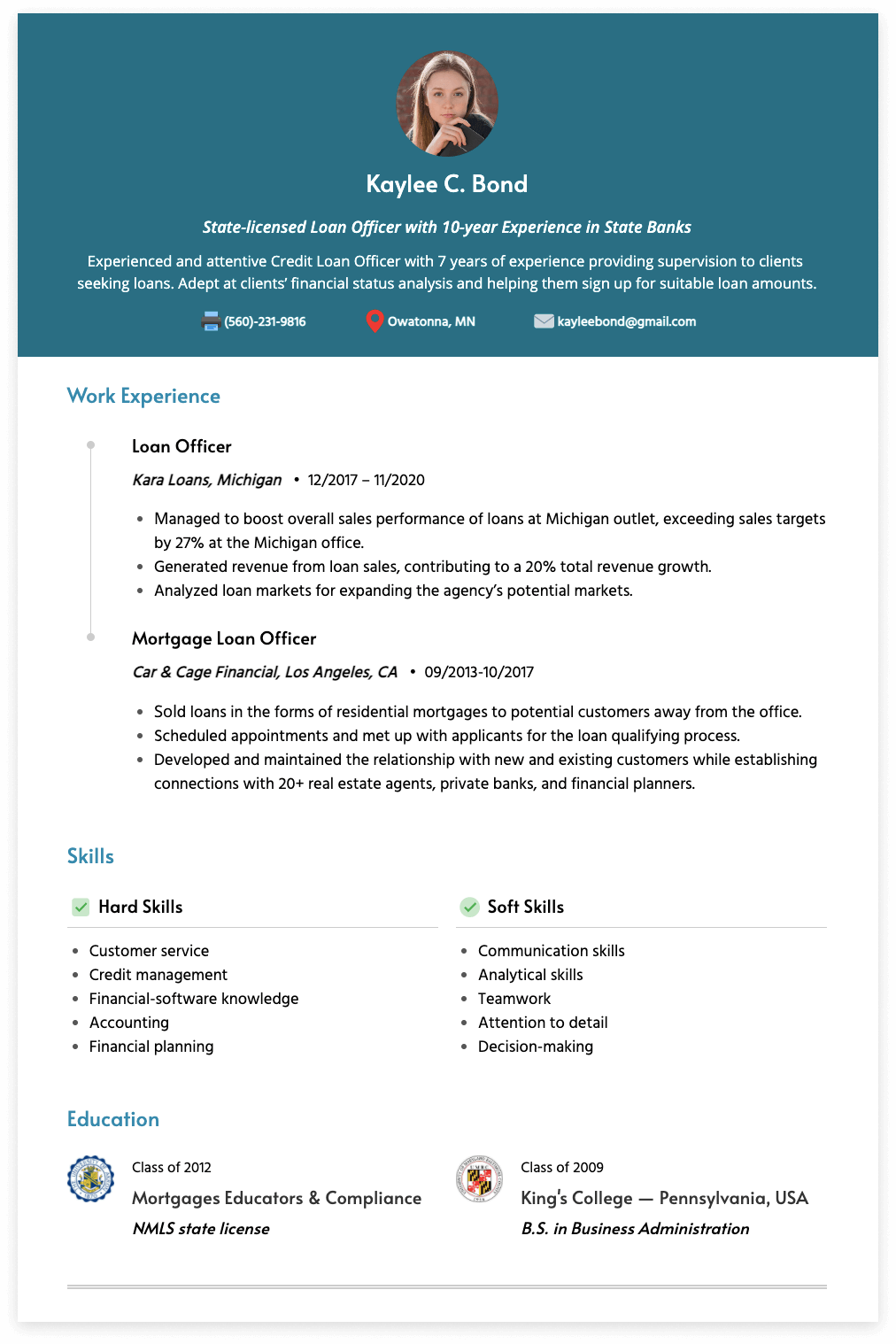

Kaylee C. Bond

State-licensed Loan Officer with 10-year Experience in State Banks

Owatonna, MN

(560) 231 9816

[email protected]

Professional Summary

Experienced and attentive Credit Loan Officer with 7 years of experience providing supervision to clients seeking loans. Adept at clients’ financial status analysis and helping them sign up for suitable loan amounts.

Work Experience

Loan Officer

Kara Loans, Michigan

12/2017 - 11/2020

- Managed to boost overall sales performance of loans at Michigan outlet, exceeding sales targets by 27% at the Michigan office.

- Generated revenue from loan sales, contributing to an 20% total revenue growth.

- Analyzed loan markets for expanding the agency’s potential markets.

Mortgage Loan Officer

Car & Cage Financial, Los Angeles, CA

09/2013-10/2017

- Sold loans in the forms of residential mortgages to potential customers away from the office.

- Scheduled appointments and met up with applicants for the loan qualifying process.

- Developed and maintained the relationship with new and existing customers while establishing connections with 20+ real estate agents, private banks, and financial planners.

Education

Mortgages Educators and Compliance

NMLS state license

Class of 2012

King's College - Pennsylvania, USA

Bachelor of Science in Business Administration

Class of 2009

Skills

Soft Skills:

- Communication skills

- Analytical skills

- Teamwork

- Attention to detail

- Decision making

Hard Skills:

- Customer service

- Credit management

- Financial-software knowledge

- Accounting

- Financial planning

--- Originally written by May Luong ---

More Career and Recruitment Resources

With the intention of helping job seekers to fully display their value, CakeResume creates an accessible free resume/CV/biodata builder, for users to build highly-customized resumes. Having a compelling resume is just like a piece of cake!