CakeResume Talent Search

Definition of Reputation Credits

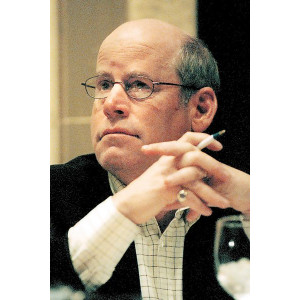

David C. Branch

David C. Branch is what one might call a classic serial entrepreneur. He's created, purchased, and sold more than 300 companies! Now Dave is a recognized and strategic leader in finance, private equity, and platform development strategies. Today he serves as a Founder and Partner of Viper Equity Partners, the country's leading transition consultation firm for the medical industry. He works with with Banks, Lawyers, Finance Partners, Equity Firms, and Analysts. Dave's main focus is Dental, Plastic Surgery and Dermatology office consolidation.

David C. Branch started Viper Equity Partners in 2009. Now his group offers a wide array of services, including M&A advisory services and full accounting and financial support. He offers twenty-five years of problem solving experience. Dave also specializes in dentistry, dermatology, and plastic surgery practice consolidation.

David C. Branch was also selected in 2018 and 2019 as one of the Top 100 People in Finance. He has also been nominated for 2020. His accomplishments don't end there-- he's also a retired Hall of Fame Athlete, 2010 APBA Sportsman of the Year, World Tailgating Champion, and Television Personality.

Founder of Viper Equity Partners

Palm Beach, FL, US

[email protected]

Work Experience

Viper Equity Partners

2009 ~ Present

Founder and Partners

Living Life LLC

1995 ~ Present

Partner

Private Equity, Acquisition, Strategic Growth and Finance Consultation

Living Life LLC

Muscle Madness The Series

Aug 1989 ~ Present

President

HMG Medical

1987 ~ 2008

CEO

Finance, Marketing and Branding Telecommunications Company. Sold

company to Sprint 1997.

Island Communications

1990 ~ 1997

Education

Johnson and Wales University

Associate's Degree Culinary Arts, 1984 ~ 1986

David C. Branch was also part of the Captain Governors Conference.

Loyola University New Orleans

Bachelor's Degree Finance/Business, 1980 ~ 1984

Dave was a member of the PKT Fraternity.

Skills

- Marketing

- Entrepreneurship

- Start-Ups

- Mergers and Acquisitions

- Commercial Real Estate

- Merger Strategies

- Marketing Strategies

- Business

Projects

5 Factors in Choosing the Right Investment

David C. Branch discusses how you can choose the right investment for you. Keep reading here.

How to Create a Budget

No matter your level of income or place in life, it's important for you to set up a budget. Here, Dave describes how.

How to Improve Your Financial Literacy

In order to build wealth and save for the future, you may need to boost your financial literacy. Learn more here.

Videos

David C. Branch shares a video he created to describe some of the best boat racing resources.

Interested in boosting your financial literacy? Check out this video to learn more about what you need to know and the resources you have available.

Social Media

Learn more about David C. Branch on social media here!

How to Cut Costs and Save During a Pandemic

Learn MoreMap

Dave and Viper Equity Partners are located in Palm Beach, Florida.

Press

2020 Predictions From Dental Support Industry Thought-Leaders

2019 was one of the most active and exciting years in the DSO segment of the dental industry. In early February, we published 2019 Recap & 2020 Predictions from 18 Dental Support Industry Thought-Leaders. Then COVID-19 hit. And it hit dentistry hard. Now that the DSO industry has started its recovery, we are revisiting those thought leaders for an update on their predictions for 2020 and beyond. Below are their thoughts as we all continue to navigate these unprecedented times.

2019 Recap & 2020 M&A Predictions for Dentistry: Thoughts from David C. Branch of Viper Equity Partners

On Tuesday, February 11, 2020, David C. Branch, Viper Equity Partners Principal, highlighted to Group Dentistry Now: “2019 was again another interesting time for the dental consolidation market. It marked the first time since 1995 that new smaller DSOs showed more acquisition growth than industry staples like Heartland and Aspen Dental. Competition has become fierce, and sellers are more educated in terms of deal structure.

Oral Surgeons are being courted by Private Equity but is now the time to sell? Viper Equity Partners responds.

The Dental Industry's Dominate Deal Maker, Viper Equity Partners, soars to over 300m in Q1 2022.

PALM BEACH, Fla., May 5, 2022 /PRNewswire/ -- The consolidation of the dental industry has been growing steadily over the last 20 years. Today, 30% of americas dentists have joined one of the 600 DSO's making it the most active market in healthcare. Deal values based on EBITDA have risen above 11x for marquee single offices. Old school bloated DSO's have given way to progressive new players with partnership models that have structures favorable to the selling doctors. These groups offer the doctors higher front-end cash with equity rolls that really pay off at recaps or the doctors' exit. Truly an amazing time for dentists and all dental specialists.

Plastic Surgeons want to know if now is the time to sell to a Private Equity Firm. Viper Equity Partners responds

David C. Branch

David C. Branch is what one might call a classic serial entrepreneur. He's created, purchased, and sold more than 300 companies! Now Dave is a recognized and strategic leader in finance, private equity, and platform development strategies. Today he serves as a Founder and Partner of Viper Equity Partners, the country's leading transition consultation firm for the medical industry. He works with with Banks, Lawyers, Finance Partners, Equity Firms, and Analysts. Dave's main focus is Dental, Plastic Surgery and Dermatology office consolidation.

David C. Branch started Viper Equity Partners in 2009. Now his group offers a wide array of services, including M&A advisory services and full accounting and financial support. He offers twenty-five years of problem solving experience. Dave also specializes in dentistry, dermatology, and plastic surgery practice consolidation.

David C. Branch was also selected in 2018 and 2019 as one of the Top 100 People in Finance. He has also been nominated for 2020. His accomplishments don't end there-- he's also a retired Hall of Fame Athlete, 2010 APBA Sportsman of the Year, World Tailgating Champion, and Television Personality.

Founder of Viper Equity Partners

Palm Beach, FL, US

[email protected]

Work Experience

Viper Equity Partners

2009 ~ Present

Founder and Partners

Living Life LLC

1995 ~ Present

Partner

Private Equity, Acquisition, Strategic Growth and Finance Consultation

Living Life LLC

Muscle Madness The Series

Aug 1989 ~ Present

President

HMG Medical

1987 ~ 2008

CEO

Finance, Marketing and Branding Telecommunications Company. Sold

company to Sprint 1997.

Island Communications

1990 ~ 1997

Education

Johnson and Wales University

Associate's Degree Culinary Arts, 1984 ~ 1986

David C. Branch was also part of the Captain Governors Conference.

Loyola University New Orleans

Bachelor's Degree Finance/Business, 1980 ~ 1984

Dave was a member of the PKT Fraternity.

Skills

- Marketing

- Entrepreneurship

- Start-Ups

- Mergers and Acquisitions

- Commercial Real Estate

- Merger Strategies

- Marketing Strategies

- Business

Projects

5 Factors in Choosing the Right Investment

David C. Branch discusses how you can choose the right investment for you. Keep reading here.

How to Create a Budget

No matter your level of income or place in life, it's important for you to set up a budget. Here, Dave describes how.

How to Improve Your Financial Literacy

In order to build wealth and save for the future, you may need to boost your financial literacy. Learn more here.

Videos

David C. Branch shares a video he created to describe some of the best boat racing resources.

Interested in boosting your financial literacy? Check out this video to learn more about what you need to know and the resources you have available.

Social Media

Learn more about David C. Branch on social media here!

How to Cut Costs and Save During a Pandemic

Learn MoreMap

Dave and Viper Equity Partners are located in Palm Beach, Florida.

Press

2020 Predictions From Dental Support Industry Thought-Leaders

2019 was one of the most active and exciting years in the DSO segment of the dental industry. In early February, we published 2019 Recap & 2020 Predictions from 18 Dental Support Industry Thought-Leaders. Then COVID-19 hit. And it hit dentistry hard. Now that the DSO industry has started its recovery, we are revisiting those thought leaders for an update on their predictions for 2020 and beyond. Below are their thoughts as we all continue to navigate these unprecedented times.

2019 Recap & 2020 M&A Predictions for Dentistry: Thoughts from David C. Branch of Viper Equity Partners

On Tuesday, February 11, 2020, David C. Branch, Viper Equity Partners Principal, highlighted to Group Dentistry Now: “2019 was again another interesting time for the dental consolidation market. It marked the first time since 1995 that new smaller DSOs showed more acquisition growth than industry staples like Heartland and Aspen Dental. Competition has become fierce, and sellers are more educated in terms of deal structure.

Oral Surgeons are being courted by Private Equity but is now the time to sell? Viper Equity Partners responds.

The Dental Industry's Dominate Deal Maker, Viper Equity Partners, soars to over 300m in Q1 2022.

PALM BEACH, Fla., May 5, 2022 /PRNewswire/ -- The consolidation of the dental industry has been growing steadily over the last 20 years. Today, 30% of americas dentists have joined one of the 600 DSO's making it the most active market in healthcare. Deal values based on EBITDA have risen above 11x for marquee single offices. Old school bloated DSO's have given way to progressive new players with partnership models that have structures favorable to the selling doctors. These groups offer the doctors higher front-end cash with equity rolls that really pay off at recaps or the doctors' exit. Truly an amazing time for dentists and all dental specialists.